In today’s world, every business starts with an idea. But who has actually tried to build a company knows that an idea alone does not go very far. Without proper guidance and early support, most ideas never turn into real businesses. That is exactly where the Startup India Seed Fund Scheme comes in.

The Government of India introduced this scheme to support founders at the earliest stage of their journey. It is meant for startups that are still shaping an idea or working on a prototype. Through the Startup India Seed Fund Scheme, founders get the financial support they need to build their product, test it in the real market, launch it, and slowly grow their startup.

This blog explains the Startup India Seed Fund Scheme in a simple and practical way and you will get a guide to apply for Startup India Seed Fund .If you are thinking about applying for the Startup India Seed Fund, this guide will help you understand how it works and what steps you should take next.

What Is the Startup India Seed Fund?

Let’s see what this Startup India Seed Fund Scheme, This scheme is introduced in 2021 as part of the Startup India initiative, and was created to give early-stage founders a strong start. With a dedicated budget of ₹945 crore, the government aims to support over 3,600 young startups across the country helping them build, test, and grow their ideas into real businesses.

The main purpose of this scheme is simple:

- Help founders who have strong ideas but no financial support.

- Enable startups to build prototypes and enter the market faster.

The government does not give funds directly to startups.Instead, the money goes to approved incubators, and these incubators evaluate your application and release funds in stages.This process makes the system transparent, faster, and growth-driven. So everyone gets a fair chance.

Why Did the Government Start This Fund?

The Government of India wants to support young entrepreneurs, especially those building:

- Innovative solutions

- New technologies

- Scalable business models

- Impact-driven products

Most new founders struggle with the first money they need.Investors also hesitate to invest at a very early stage.The Seed Fund Scheme fills this gap.

It helps you with:

- Proof of Concept

- Prototype development

- Product trials

- Market entry

- Early scaling

- Commercial launch

If you have an idea but you don’t know where to start your business, this scheme gives you clarity and the foundation you need.

How is Seed Funding different from growth-stage funding?

Seed funding is the first stage of investment for a business where the business could consist of only a product idea and is still in the market validation process. Since the startup is in its early stages and often hasn’t yet proven its merit in the market, this funding generally involves risk on the part of the entity that is funding.

But high risk also comes at a point when the startup’s valuation is at a low and has potential to scale and yield lucrative returns.

As a result, investors bring in money at this stage through convertible preference share or common equity. They don’t prefer debt instruments with fixed interest rate burden on the startup since the early-stage startups are asset light with no validation of their business model. Grants are also a preferred instrument but are offered by Government schemes or competitions created for the purpose of promotion of entrepreneurship.

What are the different ways to raise Seed Funding?

1.Incubators:

Business incubators are institutions, government-supported or privately held, that support entrepreneurs in developing their businesses, Focus in the initial stages. These are institutions geared towards speeding up the growth and success of startups and early-stage companies.

Incubation is usually done by institutions which have experience in the business and technology world. These institutions provide infrastructure/research facilities, administrative support, and mentorship.

2.Angel Investors and Family Officers:

Angel investors are wealthy private investors focused on financing small ventures in exchange for a stake in the business. Unlike a venture capital firm that uses an investment fund, angels use their own net worth.

These are usually the first investors in a startup. These investors are driven by personal beliefs, demand higher control over portfolio companies, and have low ticket size investments.

3.Venture Capital Funds:

Venture capital funds are also managed investment pools that invest in high-growth startups and other early-stage firms and are typically only open to accredited investors. VC funds look out for startups that are highly scalable and have a huge target market.

They also demand much control over their portfolio companies. It should be noted that all VCs may not focus on seed funding as they typically focus on companies already in the market.

4.Government Funds:

Funding from angel investors and venture capital firms becomes available to startups only after the proof of concept has been provided. Similarly, banks provide loans only to asset-backed applicants. It is essential to provide seed funding to startups with an innovative idea to conduct proof of concept trials.

How Much Funding Can You Get?

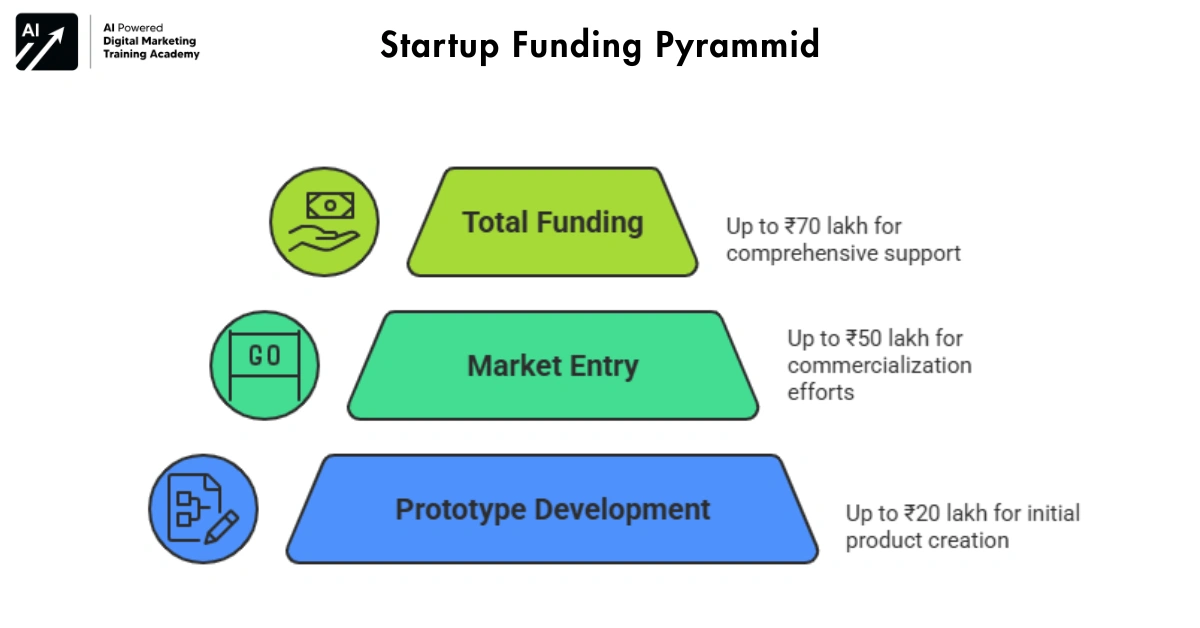

Under the Startup India Seed Fund, a startup can receive up to ₹20 lakh for Prototype Development.

You can use this money for:

- Building your prototype

- For testing your ideas

- To Develop MVP (Minimum Viable Product)

- Conducting early-stage research

- Small-scale technical experiments

Up to ₹50 lakh for Market Entry & Commercialization

You can use this money for:

- Early marketing

- Sales setup

- Market testing

- Hiring critical resources

- Scalability support

- Product launch activities

Total Possible Funding: ₹70 lakh

If your proposal meets the incubator’s criteria and your idea shows strong potential, you can receive full support immediately.

Who Can Apply for the Seed Fund Scheme?

The government created clear rules so only genuine startups can apply for this scheme.If you meet all the points below, you can apply confidently.

Must be a DPIIT-recognized startup

Your startup should have a valid Department for Promotion of Industry and Internal Trade (DPIIT) Registration Certificate.

Your Idea Should Be Innovative and Built to Grow

This program is designed for startups that are using technology which are used to solve real-life problems and have the chance to find something bigger.

Idea must be innovative, tech-driven, and scalable

The scheme supports businesses that use technology to solve real problems.

Should NOT have received more than ₹10 lakh from other government schemes

This ensures fair distribution and supports new founders.

Must not be a subsidiary or a franchise

The scheme supports original ideas and genuine founders.

Indian founder must hold majority stake

At least 51% of the shareholding should belong to Indian founders.If your startup ticks these boxes, you are eligible to apply.

How Does the Funding Process Work?

The structure of this scheme is simple and founder-friendly.

Step 1: Register on the Startup India Portal

Create your profile and get DPIIT recognition (if you don’t already have it).

Step 2: Choose an Incubator

You can browse a list of approved incubators on the same portal. So this will be helpful to you.

Step 3: Submit Your Application

You must upload:

- Pitch deck

- Business plan

- Problem statement

- Solution

- Traction (if any)

- Financial projections

- Founder details

Step 4: Incubator Evaluates Your Idea

They analyze the following things

- Innovation

- Market potential

- Scalability

- Team capability

- Revenue possibility

Step 5: Funding Gets Released in Milestones

Once it gets approved, incubators release funds stage-by-stage based on your progress.

Step 6: You Build, Test, Launch, and Scale

You use the funds to develop your idea into a real business.This flow ensures that the money helps you grow step by step.

Why This Fund Is a Big Break for Indian Founders

Early-stage founders face similar problems:

- Initial funding is not needed

- Support system is not required

- No prototype development money

- Market testing budget

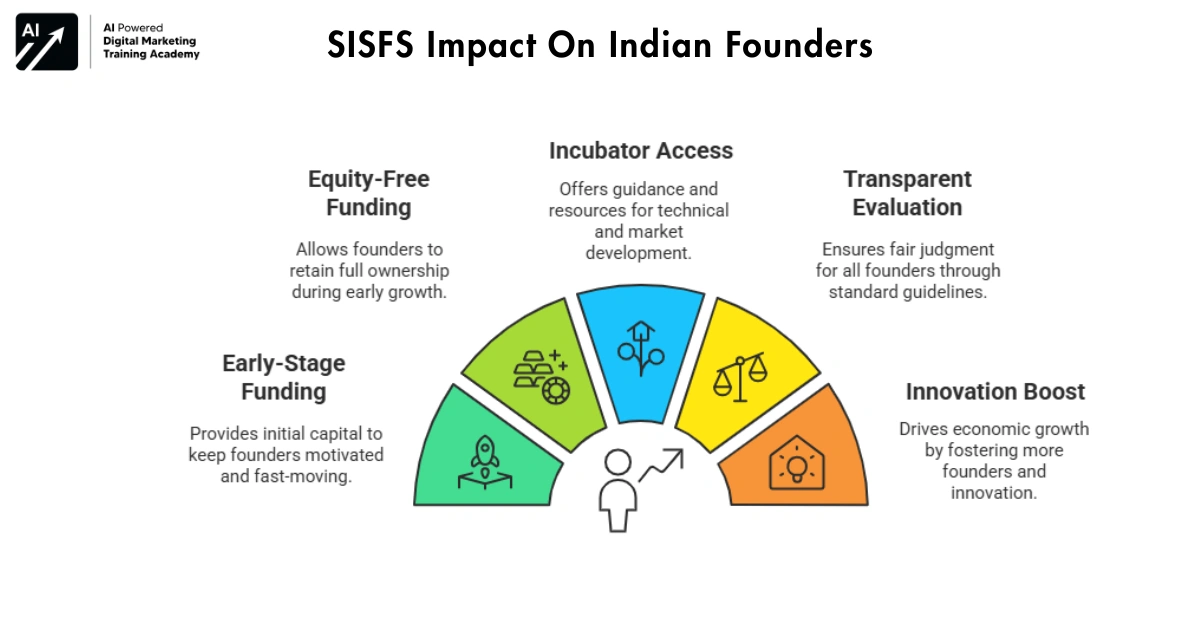

The SISFS solves these core issues and here’s why it matters:

High-value support at the right time

Early-stage money helps founders stay motivated and move faster.

Funding without giving equity

You do not give up your company shares.This keeps your ownership strong during early growth.

Access to incubators and mentors

Approved incubators guide you through:

- Technical development

- Product refinement

- Market strategy

- Pitching

- Scaling

Transparent evaluation

The scheme uses standard guidelines so every founder receives fair judgment.

Boost to India’s innovation ecosystem

- More founders

- More innovation

- More jobs

- Stronger economy.

What Makes This Scheme Different from Other Startup Schemes?

There are many government schemes, but this Startup India Seed Fund Scheme stands out because:

- Main focuses on idea-stage, not growth-stage startups.

- Supports technology-driven innovation.

- Offers milestone-based funds, not loans.

- No complex paperwork.

- It gives access to India’s top incubators.

- It offers money without interest or equity loss.

Most importantly, it supports very early-stage founders who usually get ignored by investors.

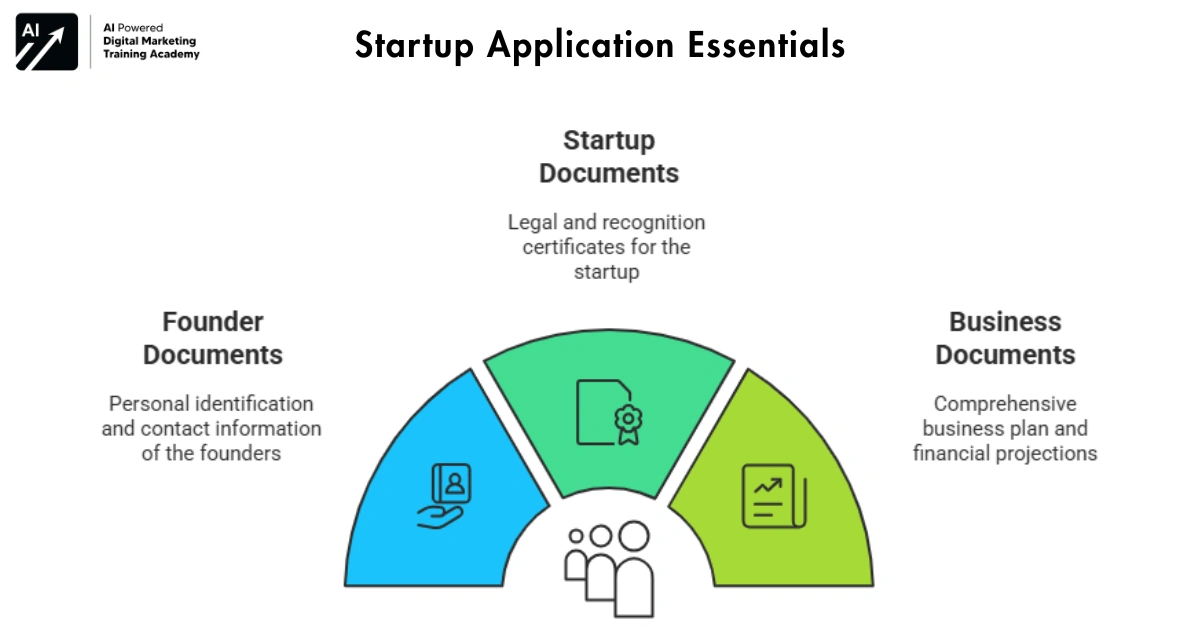

What Documents Do You Need to Apply?

Here is a clean checklist and try to make a note of these documents

Founder Documents

- Aadhaar Card

- PAN Card

- Contact details

- Educational background details

Startup Documents

- DPIIT Recognition certificate

- Certificate of incorporation

- CIN/LLPIN

- Company PAN

Business Documents

- Pitch deck

- Problem & solution statement

- Business model

- Market research

- Financial projections

- Team details

- Prototype details (if any)

- Revenue details (if any)

Once these are ready, you can submit the application easily.

What Are Incubators Looking for?

Here you can get an idea for what Incubators are looking for and Incubators fund startups that show strong potential.

They check:

- Uniqueness of the idea

- Strength of the founder & team

- Technology involvement

- Market demand

- Scalability

- Prototype stage

- Expected impact

- Revenue potential

- Social or economic benefit

If your idea solves a strong real-world problem, then you have a high chance of getting selected.

How to Increase Your Chances of Approval

Here are the few tips to increase your chances for approval for the scheme

- Show a clear problem and a strong solution

- Present a neat and visual pitch deck

- Highlight why your idea is unique

- Show early customer interest if possible

- Keep financial projections realistic

- Show passion and clarity in your plan

- Write a simple, strong business model

- Use clear, everyday words, nothing complicated.

Incubators support founders who know what they want to build.

Sectors That Get High Priority

While all innovative sectors can apply, the scheme especially useful for the following sectors:

- FinTech

- HealthTech

- AgriTech

- EdTech

- AI/ML

- Robotics

- Cleantech

- EV & Mobility

- SaaS

- DeepTech

- Biotechnology

- Internet of Things (IOT)

- Manufacturing innovation

If your idea fits in these areas, your chances might increase.

Real Use Cases of Seed Fund Support

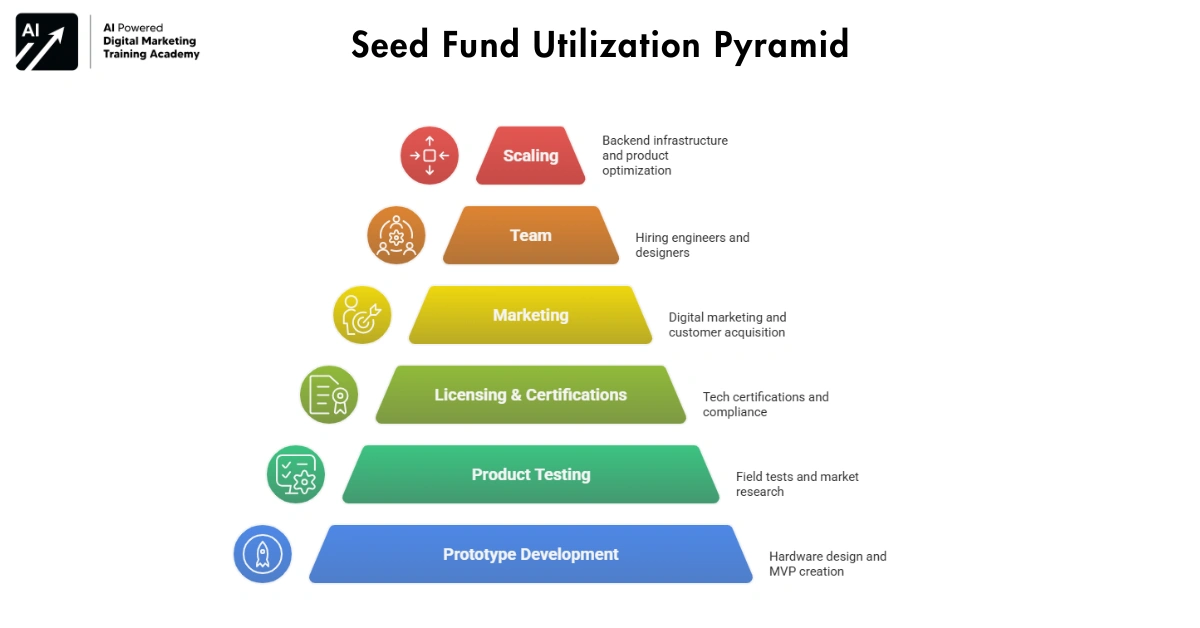

Startups usually use the seed fund for the following:

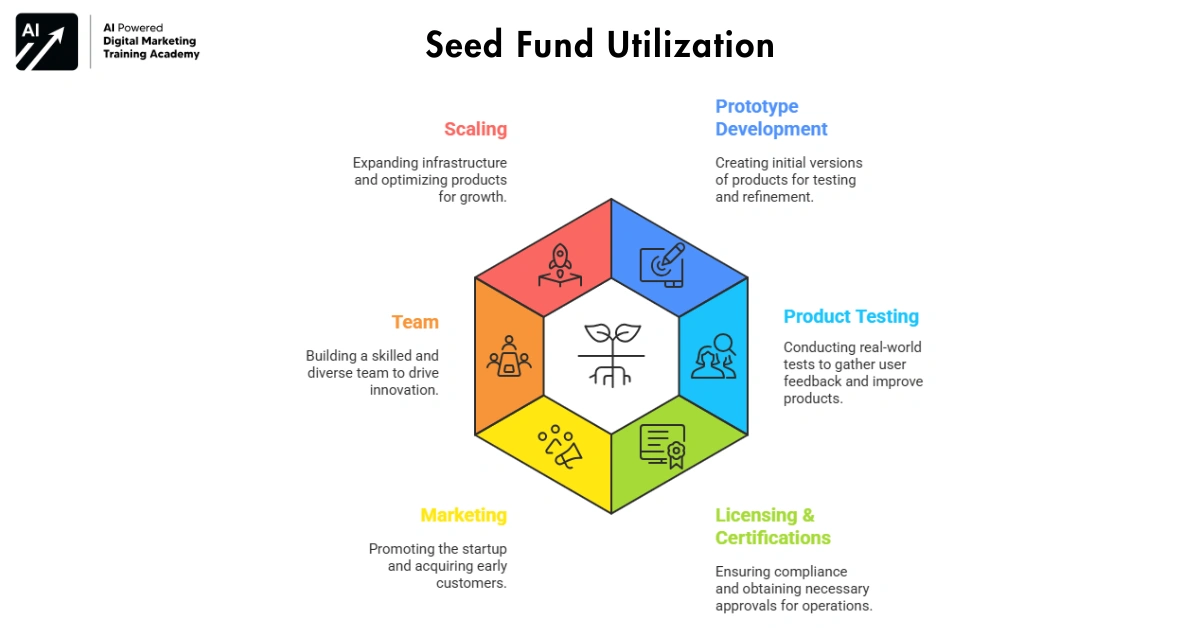

Prototype Development

Hardware design, MVP creation, app development, tech setup.

Product Testing

Field tests, user testing, beta launch, market research.

Licensing or Certifications

Tech certifications, compliance processes.

Marketing

Helps for Digital marketing, branding, early customer acquisition.

Team

Hiring engineers, developers, UI/UX designers.

Scaling

Scaling means -Backend infrastructure, product optimization.This fund covers almost all early-stage needs.

Step-by-Step Guide to Apply

Here I am providing step-by step guide to apply for India Seed Fund Scheme

Step 1: Visit Startup India portal

Step 2: Register or log in

Step 3: Ensure your startup is DPIIT recognized

Step 4: Open Seed Fund Scheme section

Step 5: Select incubator

Step 6: Submit your application

Step 7: Upload pitch deck along with supporting documents

Step 8: Wait for incubator review

Step 9: Attend screening or pitching

Step 10: Receive fund in milestones if selected

Why You Should Apply Today

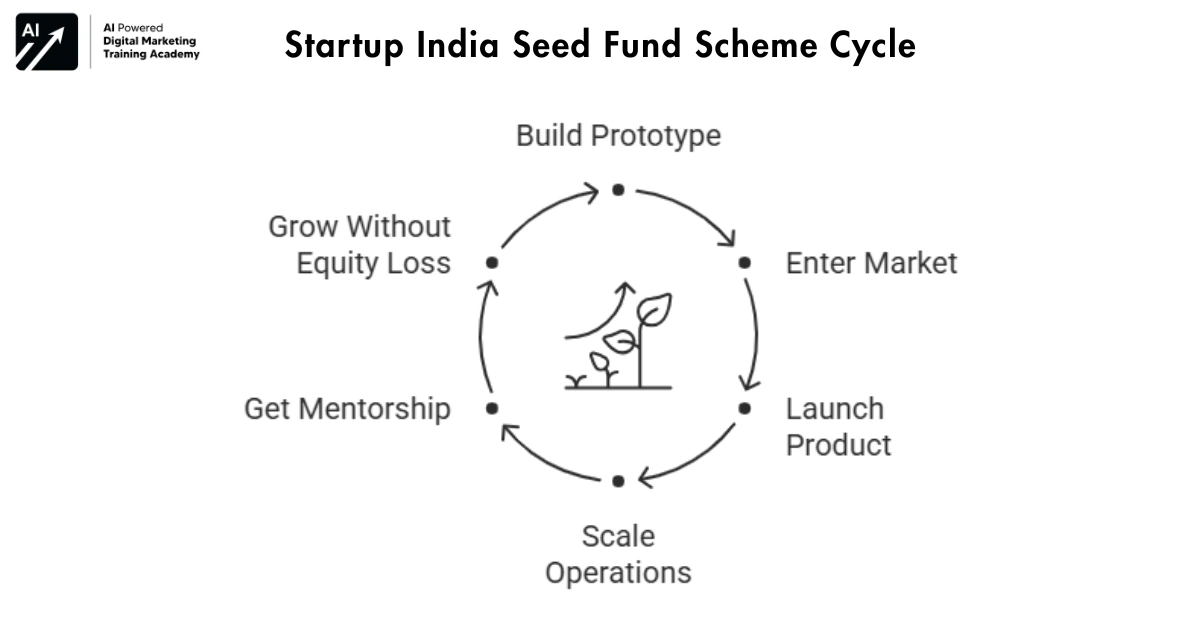

Here are a few reasons why you should apply for this Startup India Seed Fund Scheme.If you are a founder with a powerful idea, the Startup India Seed Fund Scheme can be your biggest opportunity.

This scheme helps you:

- Build your prototype

- Enter the market

- Launch your product

- Scale your early operations

- Get expert mentorship

- Grow without giving up equity

Your idea deserves a chance so this scheme gives you the platform you need.

- If you are waiting for the right time, this is the time.

- For first money, this is your funding.

- If you require any support, this is your support.

Start to fill your application today and your startup journey begins now.