Let’s be honest. School taught us maths, science, and history, but it never taught us how money really works or the basic rules of personal finance. Most of us grow up with a simple pattern in mind: we earn money, spend money, and hope everything turns out fine.

But real life doesn’t work like that.People earn well and still struggle. Some earn less and still live peacefully. The difference is not salary, the difference is money habits.

These 9 money rules are not secret tricks. They are simple shortcuts practical personal finance rules that help you avoid mistakes, grow money slowly, and protect your future. No complicated terms. No heavy finance talk. Just practical money wisdom.

Let’s go step by step.

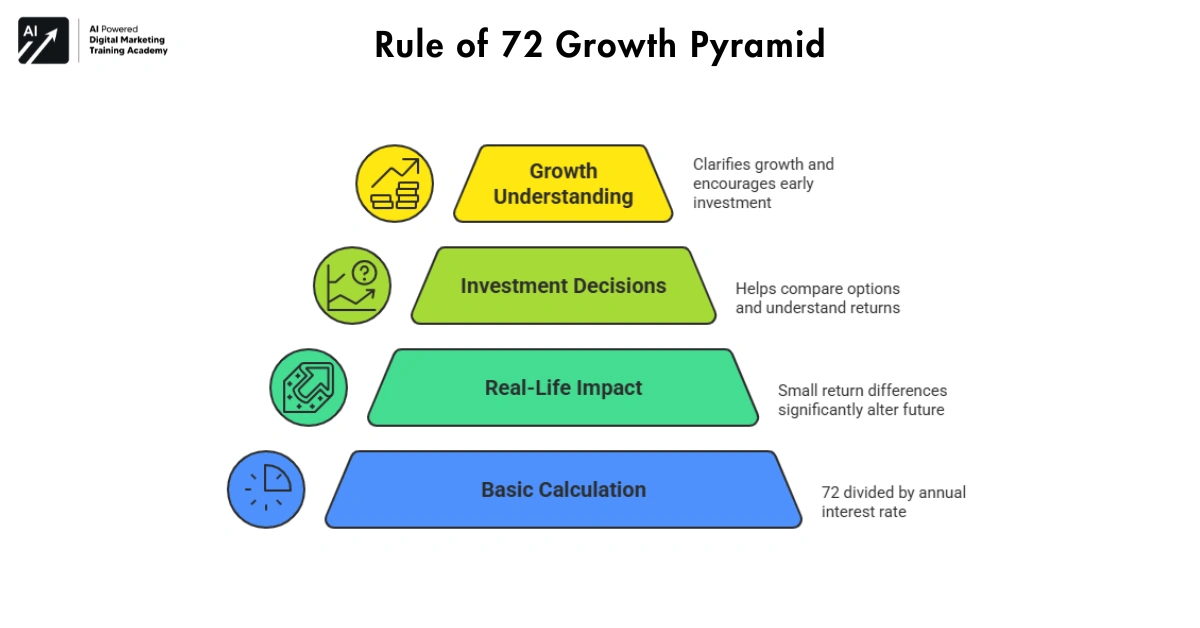

Rule 1: The Rule of 72 (How Your Money Doubles)

What Is the Rule of 72?

The Rule of 72 is one of the easiest ways to understand how fast your money grows.

- You don’t need a calculator.

- You don’t need financial knowledge.

- Just remember one number: 72.

To know how many years your money takes to double, simply:

- 72 ÷ Annual Interest Rate

- That’s it.

Simple Example Anyone Can Understand

Let’s say you invest your money at 8% return.

72 ÷ 8 = 9 years

This means the following:

Your money will double in 9 years

- ₹1 lakh becomes ₹2 lakh

- ₹5 lakh becomes ₹10 lakh

Now look at this:

- At 6% return → 72 ÷ 6 = 12 years

- At 9% return → 72 ÷ 9 = 8 years

Just 1-2% difference in returns changes your future a lot.That’s powerful.

Why This Personal Finance Rule Is Important in Real Life

Many people keep money only in savings accounts or low-interest options. They feel safe, but they lose time.Let’s be honest and real time is more valuable than money. If you delay investing.

choose very low returns:

- Your money grows slowly

- Inflation eats value

- Your future goals get delayed

The Rule of 72 helps you compare options quickly. It shows which investment grows faster and explains why returns and starting early matter in personal finance rules.

A Small Real-Life Situation

Imagine two friends.

- Friend A invests ₹2 lakh at 6%.

- Friend B invests ₹2 lakh at 9%.

- Friend A waits 12 years to double money.

- Friend B waits only 8 years.

Same money and time but with different decisions. That’s how money quietly rewards smart thinking.

A Gentle Warning (Very Important)

This rule is only an approximation, It’s not exact science. Returns are not fixed every year. Markets go up and down. But as a thinking tool, this rule is gold.

It helps you:

- Ask better questions

- Avoid blind decisions

- Understand growth clearly

Simple Take away from Rule of 72

- Higher returns = Faster growth

- Small percentage differences matter a lot

- Starting early gives huge advantage

- Understanding growth makes you confident

Once you understand this rule, you’ll never look at interest rates the same way again.

Rule 2: The Rule of 70 (Inflation Will Cut Your Money in Half)

How Personal Finance Rules Help You Handle Inflation

Most people worry about losing money in the stock market. Very few people worry about inflation. That’s surprising, because inflation is the slowest and most powerful thief of money. It doesn’t shout, scare you.

It quietly reduces what your money can buy. Things that cost around ₹100 today may cost ₹200 tomorrow. Your salary may increase but the expenses also increase along with your salary. This is where the Rule of 70 becomes important.

What Is the Rule of 70?

The Rule of 70 helps you understand how fast inflation reduces the value of your money.

The formula is simple:

- 70 ÷ Inflation Rate

- The answer tells you how many years it takes for your money’s value to become half

Simple Example Anyone Can Relate To

- Let’s say inflation is 7%.

- 70 ÷ 7 = 10 years

For suppose ₹1 lakh today will feel like ₹50,000 after 10 years. Your savings may look the same, but buying power drops. Now think about this honestly. If your money grows at 5%, but inflation is 7%, you are actually losing money, not saving it.

Why This Rule Is an Eye-Opener

Many people feel happy seeing money in their bank account. But happiness fades when expenses rise faster. The Rule of 70 helps you and gives the real returns and alos stop trusting savings accounts blindly. Think beyond fixed deposits. Saving money is not enough. Growing money is necessary.

A Real-Life Situation

A person saved ₹10 lakh in a bank account for 10 years.

- Inflation averaged around 7%.

- After 10 years:

- The amount still looks like ₹10 lakh

- But the value feels like ₹5 lakh

- That’s inflation doing its job.

Simple Take away from Rule of 70

- Inflation cuts money silently

- Low returns don’t protect wealth

- You must beat inflation to stay safe

- Awareness is the first step

Once you understand inflation, you stop being lazy with money.

Rule 3: The 4.1% Rule – One of the Most Important Personal Finance Rules for Financial Freedom

What Does Financial Freedom Really Mean?

Financial freedom doesn’t mean being super rich.

It means:

- You don’t worry about monthly expenses, automatically your money works for you.

- You don’t depend fully on salary

The 4.1% Rule helps you understand how much money you need to reach that stage.

How the 4.1% Rule Works

This rule says:

- If you withdraw only 4%-4.1% of your total savings every year, your money can last for decades.

The thumb rule is, Corpus Required = 25 × Annual Expenses.

Simple Example for Clarity

For Suppose let’s say your yearly expenses after the age 50 are ₹5,00,000.

How to manage it:

- 50% in equity and fixed income.

- Withdraw only 4% every year.

This method has worked 96% of the time over a 30-year period.

Why This Rule Makes Sense

Instead of guessing retirement numbers, this rule gives clarity. It helps you, set clear goals and avoid more savings and less savings and start a plan according to that.

- “You stop asking – Is this enough?”

- “You start asking – How do I reach this number?”

Important Reminder

This is not financial advice with market and life changes.

- But this rule gives a strong starting point.

- Always review your plan as income and expenses change.

Simple Take away from the 4.1% Rule

Financial freedom is about planning, not just luck and knowing your number reduces fear and also discipline matters more than income. Calm planning beats emotional decisions

Historically, this approach has worked well in long-term studies, but results depend on market conditions, inflation, and asset allocation.

Rule 4 : Personal Finance Rules: The 100 Minus Age Rule for Smart Investing

Why This Rule Matters

Let’s admit something. Most people invest blindly. Stocks, mutual funds, FDs mix everything without thinking. Sometimes, you take too much risk. Sometimes, you play too safe. Both hurt your future.

The 100 minus age rule is a simple guideline to balance risk and safety in your investments. It helps you decide how much money should go into equities (higher risk, higher growth) and how much in debt or fixed income (safer, lower growth).

How the Rule Works

Formula is simple:

- Equity % = 100 – Your Age

- Debt % = Your Age

This creates an opinion because younger people have more time to recover from market trends. Older people need stability.

What Really Happened

So here a sample explained Rahul, age 28, wanted to invest for long-term growth. He followed this rule:

- 70% in diversified equity funds

- 30% in fixed deposits

Over 10 years, his equity grew much faster than debt, giving him a strong corpus. Meanwhile, the debt portion protected him in down years. He avoided panic selling.

The rule doesn’t promise exact results, but it keeps risk within reason. That’s what makes it practical.

Key Points

As we know most of the young people can take more risks, while older people should be more careful.

- Always rebalance your portfolio every few years

- This rule simplifies complicated asset allocation decisions

Even small adjustments using this formula make a huge difference over decades. Honestly, understanding your risk appetite is half the battle. With this rule, you don’t have to be a finance expert.

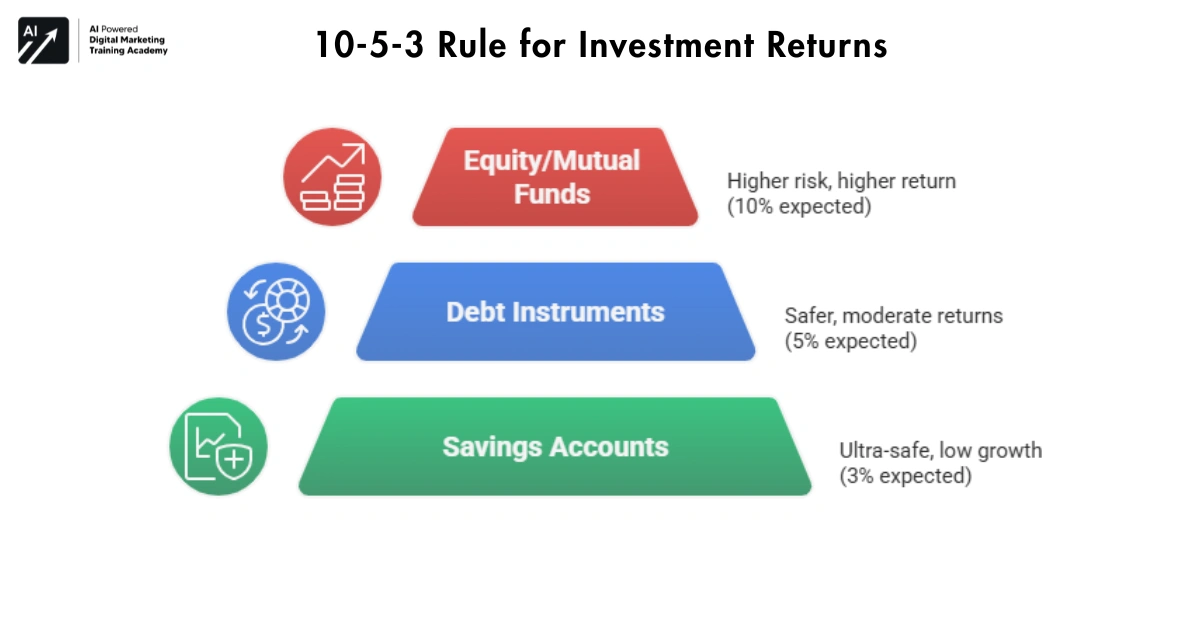

Rule 5 :How the 10-5-3 Rule Fits into Personal Finance Rules

Why Setting Expectations Matters

Basically many people expect 10% returns on savings accounts and they feel frustrated when investments don’t match to their dreams. Setting realistic expectations prevents disappointment and poor decisions.

The 10-5-3 rule helps you set target returns based on investment type:

- 10% → Equity / Mutual Funds

- 5% → Debt instruments like FDs, bonds

- 3% → Savings accounts

Let’s Understand the Numbers

Let’s discuss now :

- Equity / Mutual Funds (10%): Higher risk, higher return. Works well when you don’t need the money soon.

- Debt Instruments (5%): Safer, moderate returns. Protect part of your corpus.

- Savings Account (3%): Ultra-safe, but low growth. Only for emergencies or liquidity.

These numbers are only just estimations and they will help you to guide your planning, not to guarantee results or act as strict rules.

Rule 6: Personal Finance Rules: The 50-30-20 Rule for Better Money Management

Why Spending Wisely Matters

Let’s be honest. Many people spend all they earn and hope for the best. This usually doesn’t give financial safety. The 50-30-20 rule can help. It’s simple, clear, and easy to follow even if you hate budgeting.

The rule divides your income into three parts:

- 50% → Needs: Rent, groceries, bills, and essential living costs

- 30% → Wants: Shopping, entertainment, travel, hobbies

- 20% → Savings: Investments: SIPs, fixed deposits, emergency funds

Benefits of the 50-30-20 Rule

- Clarity: You know exactly where your money goes

- Control: Avoids overspending or impulsive buys

- Growth: Regular savings build wealth over time

- Peace of Mind: You don’t panic if expenses spike unexpectedly

Honestly, following this rule turns money management from stressful to effortless. It’s like giving every rupee a purpose.

A Small Tip

If savings are around 20% hard, start with 10 to 15% and increase gradually. Even small steps compound over time. Mainly here consistency matters more than perfection.

Why this 50-30-20 Rule Works

What needs first, then go with second, try to save money always. Small, consistent savings beat occasional big investments. Treat savings as a non-negotiable expense with balance enjoyment and security.

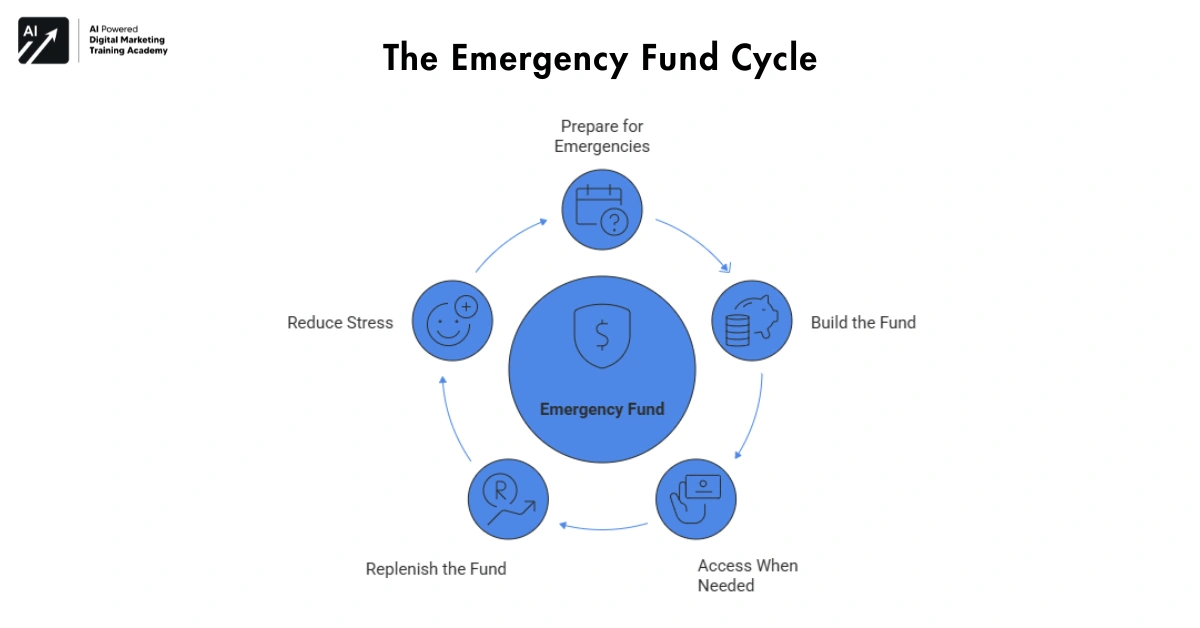

Rule 7 : The Emergency Fund Rule in Personal Finance Rules

Why Following Personal Finance Rules Helps in Emergencies

As we know life is unpredictable. If you are Job loss, medical emergencies, sudden repairs they happen at any time. Many people live without a safety net and panic when a crisis strikes. That’s where the emergency fund becomes a lifesaver.

How Much Should You Need to Keep Aside?

A general guideline, Keep your 3 to 6 months income aside.

- Conservative approach → 3X monthly income

- Safer approach → 6X monthly income

Keep it in liquid near-liquid assets like savings account, liquid funds.

Example:

- Your Monthly income- ₹50,000

- Your Minimum fund – ₹1,50,000

- Safer funds for you – ₹3,00,000

This ensures you can survive without borrowing during emergencies.

Practical Tips to Build an Emergency Fund

- Start small – even ₹5,000/month counts

- Automate transfers – treat it like a bill

- Avoid touching it unless truly necessary

Keep it liquid, easily accessible when needed, following basic personal finance rules for emergencies.

Key Takeaways from the Emergency Fund Rule in Personal Finance Rules

- Life is unpredictable; be prepared

- Build a fund covering 3 to 6 months of expenses

- Liquid assets = instant access

- Reduces panic and keeps financial goals intact

Honestly, this is the rule most people ignore, but it’s one of the most important.

Final Thoughts: Simple Personal Finance Rules That Work

Money management is not about earning more. It is about following the right personal finance rules at the right time.

These personal finance rules help you spend better, save regularly, grow your money, and stay safe during emergencies. You don’t need to apply everything at once, only just start with one rule, practice it daily, and slowly build better money habits.

When you follow these simple personal finance rules, automatically your money stops feeling confusing and stressful. Basically you feel more confident and more prepared with having control of your future.

“Remember, small steps taken today can protect your tomorrow.”