In a digitally driven world as far as financial products are concerned, taking a stand in an overcrowded marketplace takes a lot, especially in India where every big brand is competing for user attention.

Ride hailing giant Ola Financial Services was not afraid to take this challenge head-on. Through the use of data-driven,

multi-channel digital marketing strategies, the company massively boosted its brand presence, product adoption, and fuelled real growth.

In this blog post, we’ll explore how Ola digital marketing strategy used smart segmentation, compelling content, and performance marketing to engage users, convert leads, and stay competitive in the dynamic fintech sector.

The Objective: Build Brand & Boost Adoption

Ola Financial Services set out with a clear set of goals:

- Increase brand visibility in a highly competitive space

- Drive adoption of its digital financial products (such as insurance, lending, and wallet services)

- Engage users on websites online and engage interest to action

It would require an astute understanding of how users acted,

channel level strategy, and continuous optimization to achieve these.

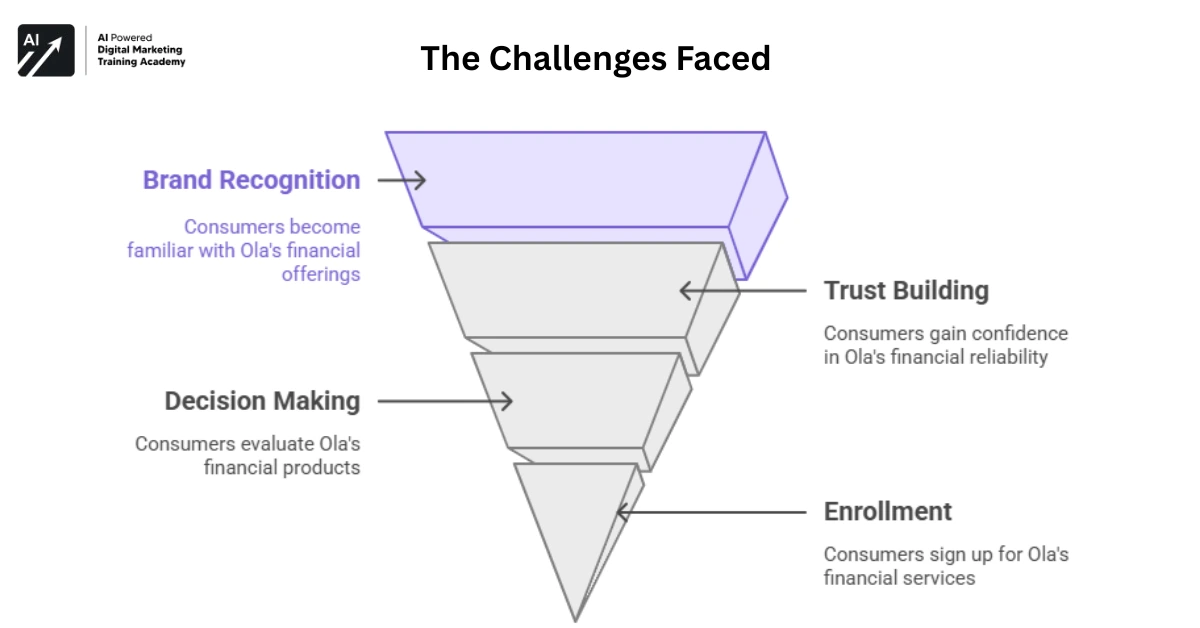

The Challenges Faced

Ola had positive name awareness in the ride-sharing space, however, Ola Financial Services was unfamiliar to most consumers.

Various challenges were present in the approach:

Intense Market Competition

The financial services market is dominated by traditional players mainly legacy banks as well as newer fintech players like Paytm, PhonePe, and Bajaj Finserv.

To differentiate, there had to be innovative digital plans and communications that resonated with users.

Low Brand Awareness for Financial Products

As great as Ola was as a brand name, its financial services wing wasn’t that well recognized.

Customers needed to be educated on the brand’s offerings and why it was reliable with something as important as money.

Driving Conversions in a Complex Funnel

Financial services involve multiple decision making phases.

From product awareness to trust concerning its safety and advantages every phase needed to be addressed in the campaign to convert interest into enrollments.

Strategy Overview Data Driven Multi Channel Performance Focused

To counter such adversities, Ola Financial Services devised an end-to-end digital marketing strategy that addressed:

- Audience segmentation

- Targeting based on platforms

- Content promotion

- Paid media

- SEO and retargeting strategies

Break it down.

Data-Driven Campaigns

Ola Financial Services relied heavily on data analysis to make every campaign smarter. Studying user interests, app behavior patterns, and web activity habits enabled the team to:

- Identify high-intent users

- Segment audiences by interest (e.g., travel, insurance, payments)

- Customize ad creatives and messages for every segment

This data-driven approach ensured that every rupee spent on ads went to the most relevant audiences.

Multi-Channel Digital Marketing

To attain the highest reach and engagement, Ola Financial Services did not rely on a single platform. Instead, it used a blend of:

- Facebook & Instagram Ads: To reach millennials and Gen Z audiences who actively consume visual media.

- Google Search Ads (SEM): To ride the demand when people searched for the relevant financial terms.

- YouTube & Display Ads: To use for storytelling on the brand and retargeting users on the internet.

- SEO: To boost organic positions and keep long-term dependence on paid promotion low.

This cross channel campaign made Ola’s brand ubiquitous wherever the user was, be it scrolling through social media or searching for loan choices on Google.

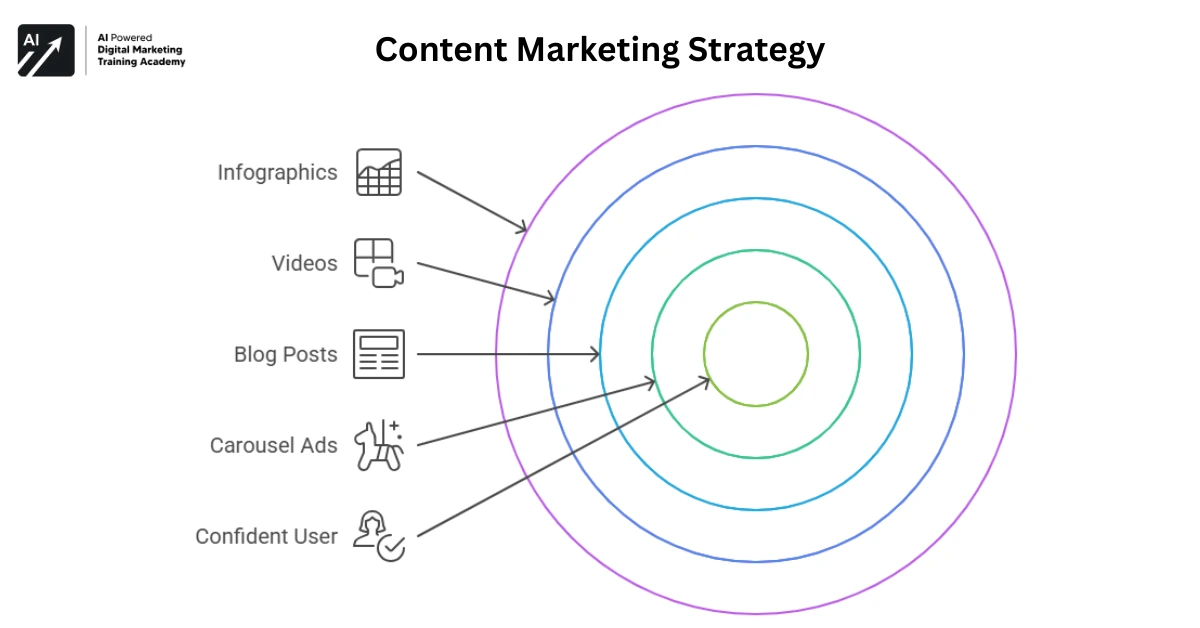

Content Marketing Strategy

Knowing that financial products are complex, Ola invested in learning-based content that simplified its products:

- Infographics explained insurance coverage and incentives

- Videos showcased real-life usage scenarios of Ola Money and lending features

- Blog posts addressed user concerns like “How to save on rides” or “Why digital wallets are more secure than cash“

- Carousel ads on Instagram made it easy to segment product features into bite-sized, consumable formats

Content was not just awareness oriented rather, it was a bridge to conversion by leaving the user feeling well-informed and confident.

Real Time Optimization and Performance Measurement

The entire campaign was monitored closely based on performance metrics such as:

- Click-Through Rate (CTR)

- Conversion Rate (CVR)

- Cost Per Acquisition (CPA)

- Return on Ad Spend (ROAS)

Real-time dashboards and A/B tests helped Ola optimize campaign elements in flight.

This meant that if a specific creative wasn’t converting or a landing page wasn’t getting converted, changes could be made immediately in order to reduce wastage and increase ROI.

Campaign Implementation Strategy into Action

With the strategy outlined, the campaign entered implementation mode:

Social Media Campaigns

- Activated high-engage campaigns on Facebook and Instagram.

- Utilized trending formats like Reels, Stories, and interactive polls.

- Blended organic and paid content to create consistency of brand with expanded reach.

Search Engine Marketing (SEM) and SEO

- Placed intent-targeted search ads on keywords like “best loan app,” “digital wallet offers,” and “car insurance India”.

- Landed page optimization with keywords to reduce bounce rate.

- Improved metadata, schema, and site speed to boost SEO rankings.

Display Retargeting

- Used Google Display Network and YouTube to retarget engaged Ola website or app users.

- Featured visual reminders of exclusive deals, cashback, and product USPs.

- Maintained top-of-mind recall throughout the user journey.

Results Measurable Growth Throughout the Funnel

The campaign drove strong results in brand awareness, user engagement, and conversions:

Brand Visibility Soared

- Millions of impressions across channels

- Strong increase in social media activity

- Brand search and mention volume growth, with improved recall

Enhanced User Engagement

- Web traffic and dwell time increased

- CTA button click and use of product tools increased

- Increase in repeat visits and decrease in bounce rate

Conversion & ROI Metrics

- ROAS rose over 40% as campaigns got optimized

- Cost per lead went down as the targeting improved

- Severe spike in Ola financial product sign-ups, especially wallet and insurance plans

Key Ola Marketing Campaign Takeaways

Ola Financial Services’ success digital campaign offers valuable insights for fintech brands and marketers:

Embrace Data-Driven Decisions

Knowing your audience using data leads to more effective messaging, reduced costs, and improved ROI.

Content Converts

Educational, useful, and engaging content turns uncertainty to know how essential to financial product promotion.

Diversify Channels

Having presence across places extends reach and keeps your brand in front of the user along the way.

Real-Time Optimization Works

Watching performance mid-campaign allows optimizations that maximize returns.

Conclusion

Ola digital marketing strategy proved that strong digital marketing can make new financial brands heard.

With proper segmentation, compelling content, and constant optimization, the company built credibility, drove conversions, and became a reliable name in India’s fintech sector.

As digital payments and financial services grow in India, this campaign is a good example of how to engage, educate, and bring on board users with smart marketing.