It is exciting to begin a startup in India like never before. With entrepreneurial spirit, online accessibility, and governmental support, India is an opportunity capital for nascent entrepreneurs.

But whereas imagination and implementation are the hallmark, knowing how to start a startup legally in India is what makes it viable in the long term

Following the law is most likely the first thing that any new entrepreneur would overlook, and thus you will lose your business.

If you are initiating a tech product, a D2C business, or a consulting firm, then go through step-by-step guidance to have an idea about how to start a startup legally in India

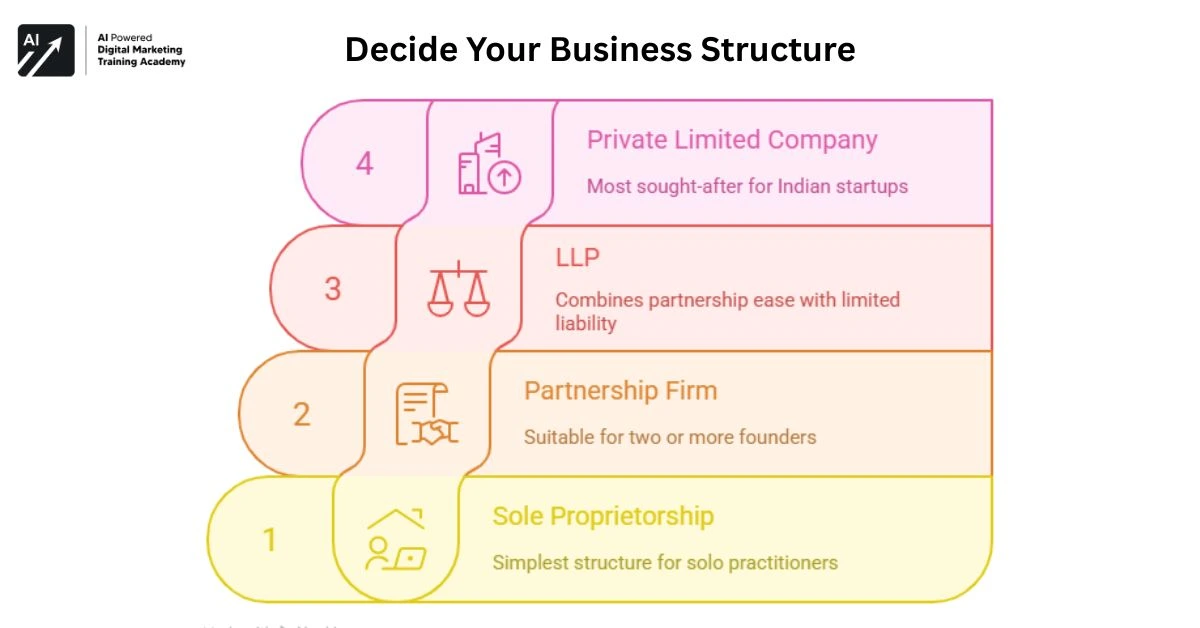

Decide Your Business Structure

Step one and number one: deciding your business structure. Who you appoint as the legal person will determine what taxes you pay, how you finance, how simple to do business, and what law protection you’ll enjoy

Sole Proprietorship

Most appropriate for solo practitioners and microbusinesses.

Simplest to register but no protection against liability. Creator and company are the same

Partnership Firm

Suitable for two-or-more founders or more startups. Regulated by the Indian Partnership Act, 1932, easy to incorporate but not scalable and does not offer liability protection

LLP (Limited Liability Partnership)

Combines partnership ease and limited liability advantages in an ideal form. Suitable for professional services or early-stage ventures or low-risk startups

Private Limited Company

Most sought-after organization for Indian startups. Features

- Limited protection of liability

- Eligibility for ESOPs and funding

- A legally accepted entity It is registered with the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013

Pro Tip: A Private Limited Company is the most popular Indian startup choice in an attempt to obtain investors and grow legally

Register Your Company with MCA

Having finalized your structure (particularly Pvt. Ltd.), registration via the MCA portal is the following step

Here is a step-by-step guide to a Private Limited Company registration:

- Apply for Digital Signature Certificate (DSC): For director e-forms that have been digitally signed

- Obtain Director Identification Number (DIN): For all the directors, along with Form DIR-3.

- Choose and Reserve Your Company Name: Use SPICe+ Part A to propose a unique name

- File SPICe+ Part B for Incorporation: File

- MoA (Memorandum of Association)

- AoA (Articles of Association)

- Director and shareholder details

- Registered office address

Once approved, you’ll receive your Certificate of Incorporation (COI), a Corporate Identification Number (CIN), and be officially recognized as a legal business entity

Apply for PAN, TAN, and Open a Bank Account

Once your company is incorporated:

- PAN (Permanent Account Number) and TAN (Tax Deduction Account Number) will be allotted by the Income Tax Department

- Use these to open a current account in your startup’s name

PAN is needed for all financial transactions, income tax returns, and banking

Signup on Startup India Portal

Startup India is a scheme run by the government to promote and encourage startups

How to signup on Startup India portal

- Visit Official Portal

- Sign up and register your startup profile

- Apply for DPIIT Recognition (Department for Promotion of Industry and Internal Trade)

Advantages of DPIIT Recognition

- 3-year income tax exemption under Section 80-IAC

- Easy access to government funding

- Faster IP (intellectual property) protection

- Angel tax exemption

- Participation in startup-specific government tenders

Apply for Mandatory Registrations

Your startup may also need the following licenses and registrations depending on your business model

GST Registration

Required if

- Your turnover exceeds ₹20 lakhs annually (₹40 lakhs for goods)

- You sell products or services across state lines

You’re an eCommerce seller Register via the official GST portal

MSME/Udyam Registration

Optional but highly recommended.

Benefits

- Lowered loan interest

- Grants and subsidies

- Government preference in tendering

Submit on udyamregistration.gov.in

Shop & Establishment License

If you have employees or an office, it is compulsory. Issued by the municipal corporation based on where your office is

Trademark Registration (Optional)

Protect your:

- Business name

- Logo

- Slogans

- Product names

Submit on to protect your brand name

Create Foundational Legal Documents

Legal documents protect you from co-founder disagreements, employee disputes, and investor miscommunication.

Founders Agreement

Details co-founder responsibilities, obligations, equity distribution, IP rights, and vesting schedule

Employment Agreements

Clearly defines job position, compensation, NDA, IP title, and termination process between your employees

Non-Disclosure Agreement (NDA)

Freelancers, interns, and partners engaged with to protect your confidential information.

Privacy Policy & Terms of Use

Required by website, mobile app, or user data collection startups. Ensures you stay IT Act 2000 and upcoming data protection regulation compliant

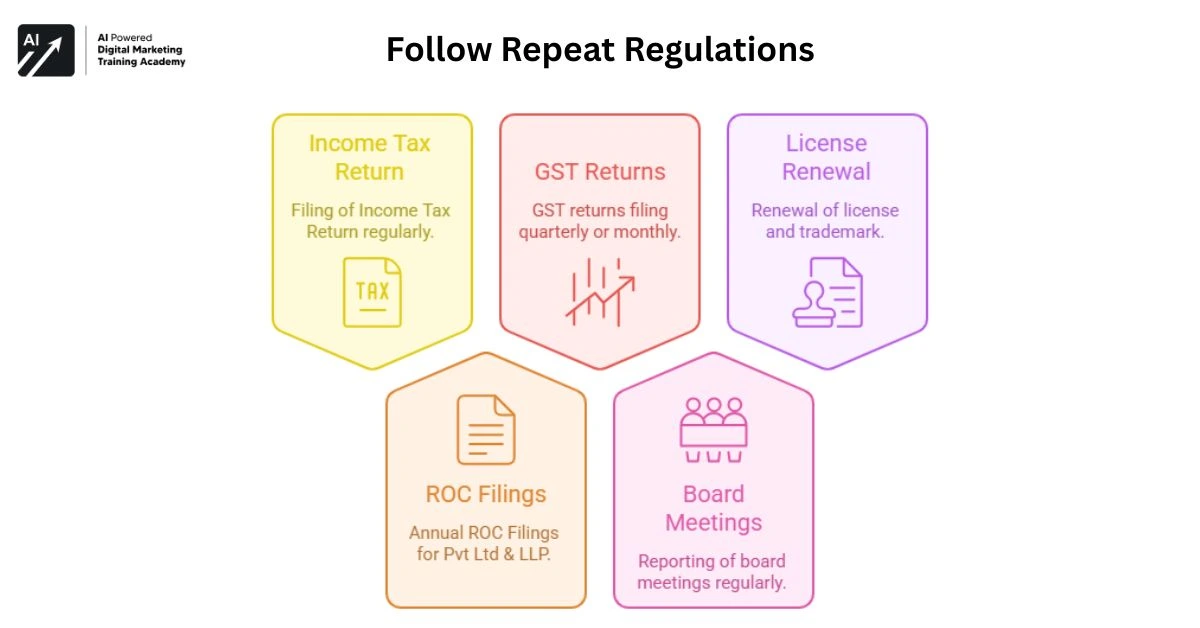

Follow Repeat Regulations

The legal process for startups isn’t a once-in-a-lifetime affair. You will have to follow regularly

- Filing of Income Tax Return (ITR)

- Annual ROC Filings (Pvt Ltd & LLP)

- GST returns (quarterly/monthly)

- Reporting of board meetings

- Renewal of license and trademark

Delaying deadlines will mean inviting penalties, disqualification of directors, or loss of recognition

Conclusion

If you aspire to initiate India’s next startup mania, recall your concept is fuel but legality is power.

Getting the authority to start your startup legally in India is the very first giant leap towards investment-fitness, brand-safety, and viability

From determining the ideal business entity to registering and filing legal documents these steps will provide your startup with the legal foundation necessary to grow up on solid ground

Red tape won’t be an issue. Get compliant by law on Day 1 and establish your startup on the solid ground of compliance, trust, and opportunity