India has quietly given startups a powerful advantage, three years of zero income tax. It may not make daily headlines, but for founders, it changes everything. Startups in the early stage handle many things. Founders build products, hire people, find customers, and manage rules, usually with little money. During this phase, taxes feel like an added pressure. This policy removes that pressure at the right time.

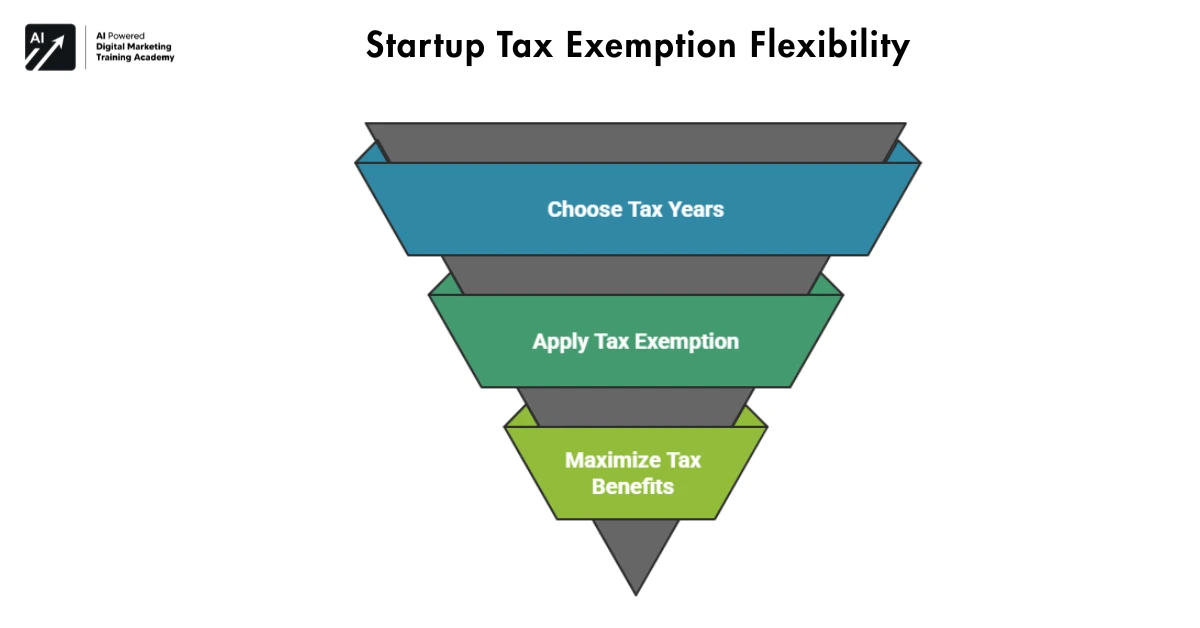

The biggest relief is simple: profits stay in the business. For three years, eligible startups keep every rupee they earn. That money goes back into growth, better talent, stronger tech, and wider reach. What makes this benefit realistic is flexibility. Startups don’t have to use it early. They can choose any three profitable years within their first ten years, when the impact is highest.

Why it matters:

- Less financial stress

- More money to reinvest

- Better long-term decisions

- Strong support for innovation

In short, India is telling founders: build first, grow steadily, and pay later.

What the Zero Tax for 3 Years Startup Scheme Really Means

A closer look reveals more than meets the eye. Startups gain flexibility, not a fixed three years. The choice depends on when they apply it. Years do not have to be chosen at once. Timing shapes its effect far more than expected. Still, it lets founders pick the best years out of a decade, shaping gains on their own terms.

A closer look reveals more than meets the eye. Startups gain flexibility, not a fixed three years. The choice depends on when they apply it. Years do not have to be chosen at once. Timing shapes its effect far more than expected. Still, it lets founders pick the best years out of a decade, shaping gains on their own terms.

Reality shows up clearly through this method. At first, plenty of new companies hit walls. Gains tend to come later, after trying things, changing direction, then checking what customers actually want. So, flexibility makes sure the help works at the right time. That way, it does some good instead of failing.

The exception covers entire profits, no split involved. For those years, full tax duty vanishes if every rule fits. Zero remains due when standards match. Notable points about the scheme:

- Pick any three years from the initial ten years

- Used when profits are high, otherwise not applicable

- Tax on income completely waived

- Connected most clearly to compliance and recognition

This setup helps founders think ahead better. Take instance, several apply the break when earnings spike, usually amid rapid expansion. Saving more as a result, growth speeds up just the same.

This approach cuts costs while boosting rewards tied to early action, steady effort, and thoughtful planning, a rare blend of logic and incentive in India’s early-stage policy moves.

The Law Behind the Benefit – Section 80-IAC Explained

Underneath each powerful incentive sits a legal foundation. Here, that foundation comes from Section 80-IAC within the Income Tax Act. It is this part that officially provides tax breaks to qualified startups, ones able to fit set standards. Not some vague pledge, the rule spells out that confirmed entrepreneurs may wipe out entire earnings, all at once, for up to three straight seasons. Yet those seasons? They fit inside just ten initial years of operation.

Clarity is what powers Section 80-IAC. Removing confusion comes first, followed by defined standards. Simultaneously, it blocks abuse through strict requirements. Real startups gain access, while others stay out. Here’s what the rule covers:

- No income tax for three years

- Selection of years based on profitability

- Legal protection through formal approval

- Hey there, founder. This one thing?

Timing matters most while gains rise, not after they trickle in. Planning early brings huge savings, often measured in crores. Black and white words on paper? That builds trust among investors. Law says it’s real, not guesswork. Predictability comes from rules written long ago. Protection lives inside official codes meant to last.

So, much turns around Section 80-IAC – it cuts tax bills, yet that’s only part of it. When startups feel assured by low taxes, so do investors, along with officials, that shared confidence shapes stronger environments over time.

Who Is Eligible for the Startup Tax Holiday in India?

Even though the benefit is quite large, access isn’t available to most people. To guide support toward strong new businesses, officials have set strict rules on who can qualify. So, those starting companies need to fulfill every requirement – none of these partial matches will work.

Even though the benefit is quite large, access isn’t available to most people. To guide support toward strong new businesses, officials have set strict rules on who can qualify. So, those starting companies need to fulfill every requirement – none of these partial matches will work.

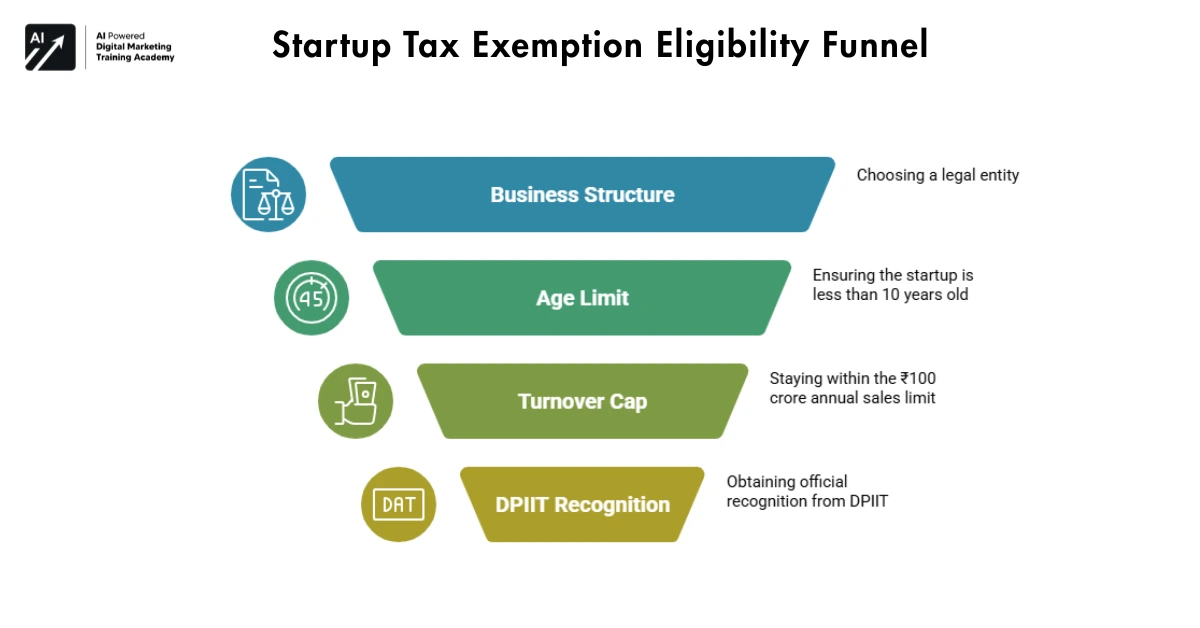

Starting out, a company should choose one of the main business forms people use. Staying under set rules for how old you are and how much money you make matters too. These checks keep things balanced so big firms cannot grab special perks meant only for new players.

Eligibility checklist:

- A private limited company, LLP, or registered partnership is required.

- Startup age must be less than 10 years

- A business cannot exceed yearly sales of ₹100 crore

- Must receive DPIIT recognition

Every element contributes something. Take the turnover cap – it helps newer companies gain access while stopping big existing players from dominating. In much the same way, setting an ending date for access keeps support focused on fresh and expanding businesses, rather than those already fully formed.

Thanks to this clear method, eligible startups get more than just tax benefits – they earn respect. Recognition by DPIIT often signals trust to outside parties like investors, banks, and collaborators. What really matters is not who gets in, but how being selective improves everything around early-stage companies. This process quietly lifts the whole scene up.

What Is DPIIT and Why Recognition Is Mandatory

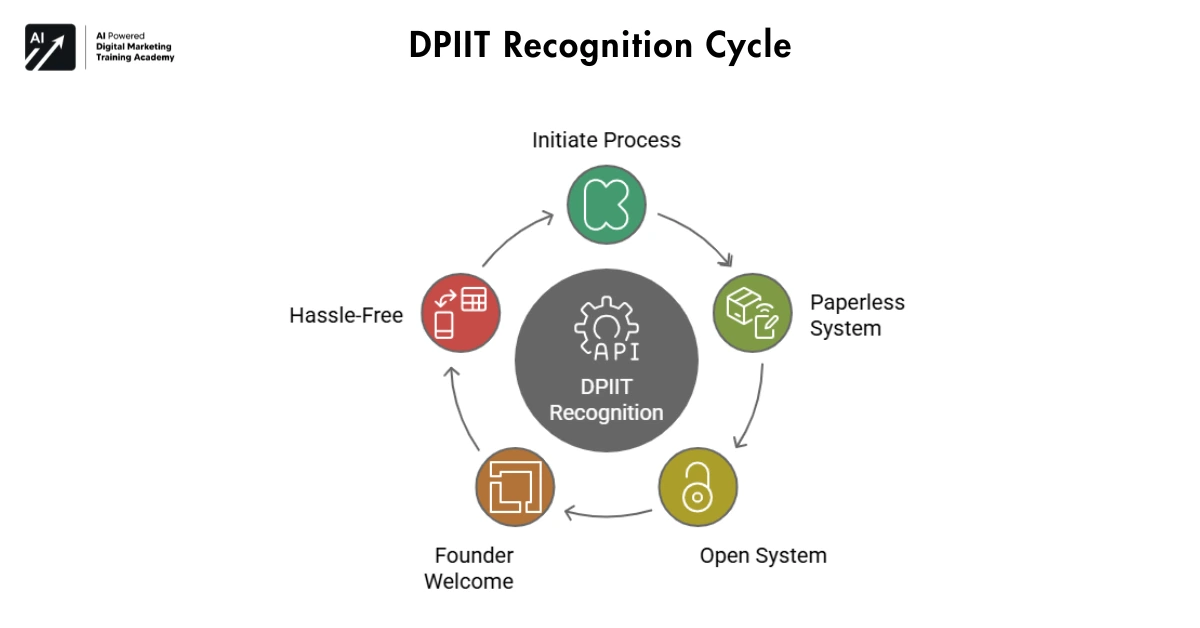

Starting in Delhi, the DPIIT (Department for Promotion of Industry and Internal Trade) label marks who gets access to India’s special perks for new companies. Before anything moves forward, officials check if a firm truly fits what a startup should be. That confirmation comes only after proper review takes place. Not everyone gets fast track – DPIIT looks closely at how new ideas work, grow, and actually mean something. Real founders are the ones who make it past review, nothing more, nothing less.

Proof matters here since tax officials need it to confirm status. Startups cannot officially apply section 80-IAC rules without this step approved. Legal access to those benefits links directly to showing DPIIT approval first.

Recognition from DPIIT offers:

- Start-up details confirmed by authority

- Eligibility for tax exemptions

- Access to government schemes

- Increased investor confidence

A seal from DPIIT means recognition. After approval, the company shifts – no longer just dreaming, now seen as real.

Seeing yourself in that role? It brings a kind of safety net. The structure becomes real, turning messy internal struggles into clear-cut entities others can understand. This shift makes handling paperwork, speaking with investors, or navigating regulations feel less chaotic.

Step-by-Step Process to Get DPIIT Startup Recognition

Starting the DPIIT process isn’t hard when handled right. Built from the ground up as a paperless, open system, it welcomes founders without hassle. Starting out, companies go through the National Single Window System. One clear entry point handles requests among different departments. Approval steps become easier to manage because everything flows together. Start here.

Starting the DPIIT process isn’t hard when handled right. Built from the ground up as a paperless, open system, it welcomes founders without hassle. Starting out, companies go through the National Single Window System. One clear entry point handles requests among different departments. Approval steps become easier to manage because everything flows together. Start here.

Each move builds on the last one:

- Create an account through the NSWS portal

- File business registration papers and company setup files

- Describe innovation or scalability

- Get the DPIIT certificate once approval is granted

After being accepted, the certificate takes on real importance. It opens doors to grants, tax advantages, along with backing under policy rules. Even if precision matters, simplicity isn’t forced into the steps. When teams handle paperwork well, young companies often get go-ahead fast.

How to Claim the 3-Year Zero Tax Benefit After DPIIT Approval

Only DPIIT recognition isn’t enough to start the tax break. Once that’s cleared, companies need to reach out to the Central Board of Direct Taxes for a formal exemption document. Approval comes before any legal move happens. Here it matters most. The CBDT certificate must be present – otherwise, no income tax exemption applies, regardless of DPIIT recognition.

Claim process:

- Get DPIIT approval

- Apply to CBDT for exemption

- Get the tax holiday certificate.

- Claim exemption while filing returns

That needs to stick in your mind – no certificate equals no tax holiday.

So, leaders need to take this part honestly. After getting okayed, the advantage moves easily into those selected years.

Real Benefits of the Startup Tax Holiday

This exception does much more than save taxes. It changes how young companies develop.

Core benefits:

- Cutting down tax costs by a big margin

- Encourages innovation and risk-taking

- Enables reinvestment into growth

- Strengthens long-term sustainability

Funding comes first, so teams get hired faster, features sharpened, customers reached wider. Growth builds on itself, layer after layer.

From Idea to Recognition to Zero Tax – India’s Startup Vision

Starting up in India. Support comes before rules take effect. Help arrives early, when companies are weakest. That aid shapes a bigger wave of new ideas.

Starting small leads to DPIIT notice, then zero taxes become real. Builders gain strength instead of facing pressure. So, India doesn’t only launch new firms – it grows them slowly. It isn’t only about taxes. This is how India fuels its startup revolution.

Final Thought

India’s three-year zero tax benefit is more than a financial relief- it is a clear vote of confidence in founders. Instead of taxing startups too early, the system gives them space to grow, stabilize, and scale.

By allowing startups to choose their most profitable years, the policy rewards smart planning rather than rushed growth. Moreover, DPIIT recognition and Section 80-IAC ensure that only genuine, innovation-driven startups benefit.

- Startups keep profits when they need them most

- Founders gain freedom to reinvest in growth

- Innovation gets time to mature without pressure

- Policy supports long-term value, not short-term tax

Ultimately, India’s startup vision is simple yet powerful: build first, strengthen next, tax later.

When ambition meets supportive policy, growth becomes sustainable and revolutions compound quietly.