Startup life is fantastic but finding the appropriate capital at the appropriate time can either shatter or make you.

Every founder wants to create something from an idea, but far too many are stopped by one solitary limitation no capital

And that is where seed funding occurs. It is the initial money that can take a startup from concept to launch,

building the early team, working on the early prototype, or taking it to market.

In India, the startup trend is flourishing with over 100,000 registered startups and increasing day by day.

But during the tough competition and insufficient right exposure to the investors, choosing the perfect seed funding platform is a sheer requirement

The step-by-step guide introduces you to Top 15 Seed Financing Platforms for Early-Stage Startups Indian and international, their funding process,

eligibility conditions, and USPs in order to help you get the perfect investment in a hassle-free manner

What Is Seed Funding and Why It Matters

Seed capital is the initial official round of financing for a startup It provides the financial building blocks to operate a business concept or an early-stage product

In essence, seed investing is helping startups prove the idea, own the category and set themselves up for larger Series A rounds

Why Seed Funding Matters

- Tracts the idea to be real: Investor interest confirms your startup.

- Gain speed: Investing enables you to hire, market, and scale fast.

- Wins more investors: Winning seed rounds makes your startup appealing to larger rounds.

- Offers mentorship: Seed financing investors have mostly domain and strategic knowledge

Top Top 15 Seed Financing Platforms for Early-Stage Startups

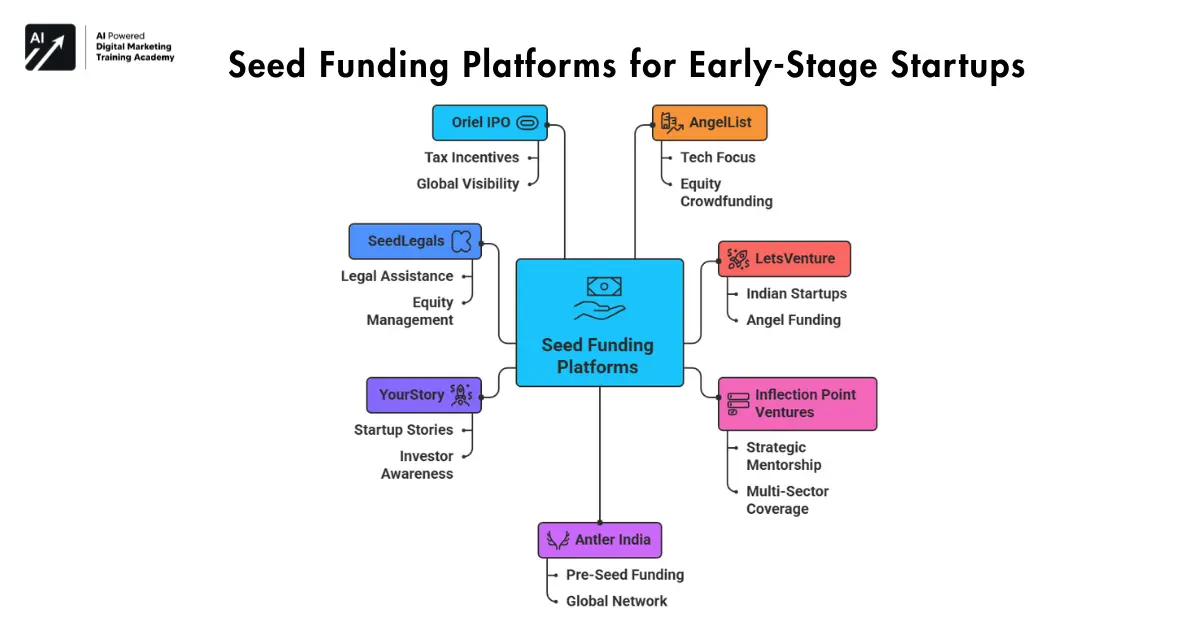

AngelList

- Focus: Tech, SaaS, HealthTech, FinTech

- Funding type: Equity Crowdfunding

AngelList is the largest startup investment platform globally, founded in 2010

AngelList bridges founders with venture funds and angel investors through syndicates.

Startups can raise, hire, and even discover acquisition opportunities all in one platform

Most Significant Features

- Access to the world’s 10+ million-member investor base.

- Syndicate investing allows for multiple backers per transaction.

- Streamlined compliance and online tracking of investments

USP: The go-to cross-border platform for technology-startups seeking early traction, and shrewd investors.

Website: angellist.com

LetsVenture

- Domain: Indian startups in all sectors

- Funding Type: Angel funding & syndicate rounds

LetsVenture shook the fundraisings for Indian startups.

It streamlines investors, legal documents, and compliance and creates a web platform for accredited investors and startups

Key Benefits

- Over 10,000 investors from over 60 countries.

- Valuation, due diligence, and shareholding management in-built features.

- Offer early-stage startup mentorship and support programs.

USP: India’s best place for early-stage entrepreneurs seeking smart money and mentorship

Website: letsventure.com

Inflection Point Ventures (IPV)

- Specialization: Indian early-stage startups

- Funding Type: Angel funding

IPV is a network of over 8,000 CXOs and professionals who invest in scalable startups.

IPV not only invests in startups but also offers them operational, HR, and strategic advice an all-round support system

Key Benefits

- Strategic mentorship and investor network.

- Multi-sector tech, consumer goods, and EV coverage.

- Experiential learning-based founder development support

USP: Best for those startups that need not just funding but also business guidance and scaling assistance

Website: ipventures.in

Antler India

- Target Audience: Pre-seed and tech-first startups

- Type of Event: Equity

Antler is a seed-stage global VC with 25+ countries presence.

Antler India tests ideas and provides up to ₹4 crore of pre-seed funding It also helps solo founders find co-founders.

Key Benefits

- Partnership and mentorship network worldwide.

- Investment from idea stage.

- Access to later-stage investors portfolio companies

USP: Helps first-time founders scale from idea to MVP with global handholding

Website: antler.co

YourStory

- Topic: Visibility of startups & investor awareness

- Funding Type: Media coverage (indirect funding)

India’s leading startup media platform, YourStory, inspires entrepreneurs by telling their stories.

This alert automatically attracts investors and accelerators

Key advantages

- Has over 100,000 startup success stories.

- Organizes pillar events like TechSparks.

- Makes startups brand credible and investor visible.

USP: Right space for early startups to get noticed and be in the investor spotlight through stories.

Website: yourstory.com

SeedLegals

- Topic: Legal tech for fundraising

- Funding Type: Compliance & legal assistance

SeedLegals simplifies startup fundraising with automated equity structures, shareholder transactions, and term sheets.

Thousands of Indian and European startups use it.

Key Benefits

- Saves up to 90% of lawyer fees.

- Provides pre-drafted investor documents.

- Equity management system provided

USP: The cheapest and fastest means of dealing with legal formalities of fundraising

Website: seedlegals.com

Oriel IPO

- Subject: Equity crowdfunding (UK-based)

- Funding Type: SEIS/EIS-backed equity crowdfunding

Oriel IPO enables start-ups to raise capital from UK investors with tax relief advantage under SEIS/EIS programs.

Even Indian origin entrepreneurs with UK registered company are included, even if domiciled in the UK.

Key Features

- Tax advantage to investor (SEIS/EIS).

- Simplistic listing for worldwide visibility.

- Sponsorship of pre-seed and growth phase

USP: Offers tax-incentivized capital for worldwide visibility and predictability of long-term capital.

Website: orielipo.com

Startup India Seed Fund Scheme (SISFS)

- Area of Focus: Indian innovation-driven startups

- Funding Type: Grants and equity

SISFS is designed by the Government of India, which finances proof-of-concept and prototype in startups through incubators

Key Benefits

- ₹945 crore corpus funding 3,600+ startups.

- Financing up to ₹20 lakh to validate an idea and ₹50 lakh to launch into the market.

- Merit-based and transparent selection

USP: Government-sponsored and most appropriate for first-time Indian startups with ideas of innovation

Website: seedfund.startupindia.gov.in

FasterCapital

- Focus: Tech startups & co-founding assistance

- Funding Type: Equity & tech development

FasterCapital is an international incubator providing co-funding and tech development assistance.

Co-funds up to 50% of investment required by startups and provides mentorship

Key Benefits

- 155,000+ investors in their international database.

- Provides development, marketing, and sales assistance.

- AI, SaaS, and EdTech startups on a deep level.

USP: For startups that need funding as well as product development partnership

Website: fastercapital.com

OpenVC

- Focus: Investor matching platform

- Funding Type: Investor access (free database)

OpenVC provides open and free investor data to founders. Startups can search geographically, by industry, or stage

Key Advantages

- 5,000+ genuine investor profiles.

- No brokerages and no fees.

- Speed and visibility of contact

USP: 100% free and open founder platform for connecting directly with the right investors

Website: openvc.app

Wefunder

- Theme: Equity crowdfunding through community

- Type of Funding: Equity crowdfunding

Wefunder allows startups to raise money directly from customers and community. Bridges the gap between retail investors and startups

Key Benefits

- Raised more than $700M for 2,000+ startups.

- Allows micro-investing of a minimum of $100.

- Backed by SEC regulation (Reg CF).

USP: Best for startups with loyal customer base seeking community-funding

Website: wefunder.com

Fundable

- Target: Startups product or expansion stage

- Funding Type: Equity & rewards-based crowdfunding

Fundable enables founders to create professional funding campaigns. Rewards and equity funding are both supported

Main Benefits

- Hybrid model best suited for most verticals.

- Access to investor network and mentorship.

- Development of marketing and pitch content included.

USP: Multi-purpose funding model perfect for early-stage and growth-stage companies

Website: fundable.com

Indiegogo

- Target: Creativity and innovation-startups

- Funding Type: Rewards-based crowdfunding

Indiegogo enables founders to raise directly from customers for new products and prototypes.

Main Benefits

- Over $2 billion funded globally.

- Backed by fixed or flexible capital.

- Appropriate for demand testing before launch

USP: Appropriate for consumer goods start-ups to check market demand

Website: indiegogo.com

StartEngine

- Target: Equity crowdfunding

- Funding Type: Equity investment

StartEngine enables start-ups to raise capital from retail investors, integrating the equity and liquidity aspects.

Key Benefits

- $1B+ raised for 500+ start-ups.

- Offers post-funding share trading platform available for liquidity.

- Endorsed by Kevin O’Leary (“Shark Tank“).

USP: Fundraising and secondary share trading for founders.

Website: startengine.com

Kickstarter

- Target Market: Hardware and creative startups

- Type of Funding: Rewards-based crowdfunding

Kickstarter is the pioneer of crowdfunding, where creators are able to crowdfund projects with public support

Most Significant Advantages

- All-or-nothing strategy builds trust.

- Access to audiences worldwide.

- Pre-launch marketing appropriate.

USP: A trusted platform for creative entrepreneurs to gain early visibility and funding

Website: kickstarter.com

How to Choose the Best Platform

Issues to Consider

- Business Type: Tech startups are listed on Antler or AngelList creative entrepreneurs are listed on Kickstarter or Indiegogo

- Stage of Growth: Pre-seed startups use SISFS or Antler growth-stage startups use LetsVenture or IPV

- Investor Expectations: Some investors are open to providing mentorship other investors demand a return on investment in the short term

- Funding Model: Equity, debt, or reward-based platforms must be selected from

Final Thoughts About Top 15 Seed Financing Platforms

India’s startup ecosystem is evolving fast but funding remains the lifeblood of growth. Top 15 Seed Financing Platforms above bridge the gap between ambitious founders and investors who believe in innovation.

Whether you’re a tech founder in Bengaluru, a social entrepreneur in Hyderabad, or a creative innovator in Mumbai, there’s a funding platform for you

Keep in mind that people invest in execution, vision, and clarity, not ideas. A good platform can be the means to global success, mentorship, and financial security