Part of the startup world is exciting but has its own lexicon. From fund-raising to building products, there’s a lingo all founders have to get up to speed on

If you’re bootstrapping or building your first investor deck, being able to talk on these terms will allow you to talk confidently and clearly

Here on this blog, we describe the Startup Terms Every New Founder Must Know what they are, why they matter, and how to leverage them to grow a successful business

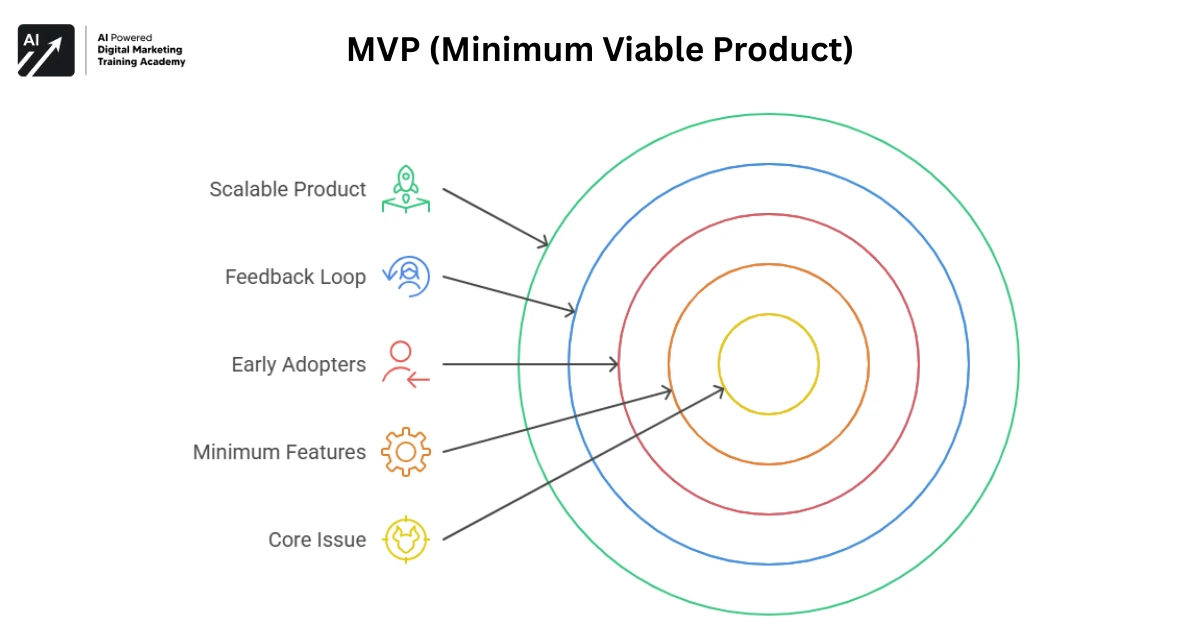

MVP (Minimum Viable Product)

What It Means

An MVP is the minimum viable product of yours that will solve the central issue

It must consist of barely enough features to get early adopters and receive feedback on how to continue to build it

Why Founders Should Know It

An MVP enables you to be on time to the market and test hypotheses against real people

It is cost-saving, inexpensive, and avoids over-engineering

All founders should have an MVP before spending a lot of money on it at scale

Product-Market Fit

What It Is:

Product-market fit is when your product fits enormous demand from a single group of customers who are willing to use and pay for it

Why It Matters

After you’ve achieved product-market fit, everything else just works: increased sales, user stickiness improves, and investors take notice of you

It is the holy grail that all founders hope for in the early stages

Bootstrapping

What It Means

Bootstrapping happens when a founder initiates and expands a startup from his or her resources or from earnings the firm makes using assistance from external investors

Why It Works

It gives complete control to the business and autonomy to entrepreneurs

Typical Indian success stories who bootstrapped are Zoho and Zerodha

Burn Rate

What It Means

Burn rate is the speed at which a startup is burning up its cash reserve until they become profitable or raise additional funds

Why You Should Monitor It:

If you want to survive, you must be aware of your burn rate

If you’re burning cash like crazy but can’t even estimate how long you will survive, your startup will blow up instantly

Runway

What It Is

Runway is how long your startup will keep running before it burns through all of its available cash,

determined by your burn rate and how much cash you have.

Why Founders Care

Your runway determines how long you’ll have to get to the critical milestones shipping your MVP

getting product-market fit, or raising your next round of funding

Pivot

What It Means

Pivot is a radical shift in your business model, strategy, or product due to performance or market feedback

When You Should Pivot:

When customers aren’t reacting, there’s a superior opportunity, or your business model isn’t serving you, a pivot can lead to new success

It’s to be anticipated and even the norm with early-stage companies

Angel Investor

What It Means

An angel investor is someone of high net worth who invests funds from his or her own pocket in start-ups, usually early on, as convertible debt or equity

Why They’re Important to Start-ups

Angel investors usually come early compared to venture capitalists and are not only able to offer cash

but guidance, mentorship, and network opportunities as well. They are usually your initial outside investors.

Term Sheet

What It Is

A term sheet is an initial, non binding agreement between founder and investor that lays out the general terms of an investment agreement

What It Includes

It typically addresses valuation, amount of investment, board composition, founder roles, and right of exit

Reading the term sheet before signing any agreement is a good idea; it sets the tone for your startup’s finances

Cap Table (Capitalization Table)

What It Means

A cap table is a table that reflects who owns what percent of your business, i.e., employee stock option holders, investors, and founders

Why Founders Should Keep It

It forces you to deal with equity, deal with dilution during fundraising, and is simply in the picture when doing due diligence

A nicely presented cap table is a sign of professionalism and inspires investor trust

Seed Funding

What It Is:

Seed capital is the first institutional round of funding a start-up company gets to develop the product, set up the market, and hire a small team.

Where It Comes From

The funding is usually from seed funds, angel investors, or incubators for startups

It is invested in scaling out of the MVP and product-market fit

The founders should be well prepared with a pitch deck and business plan in advance when they are pitching to seed funders

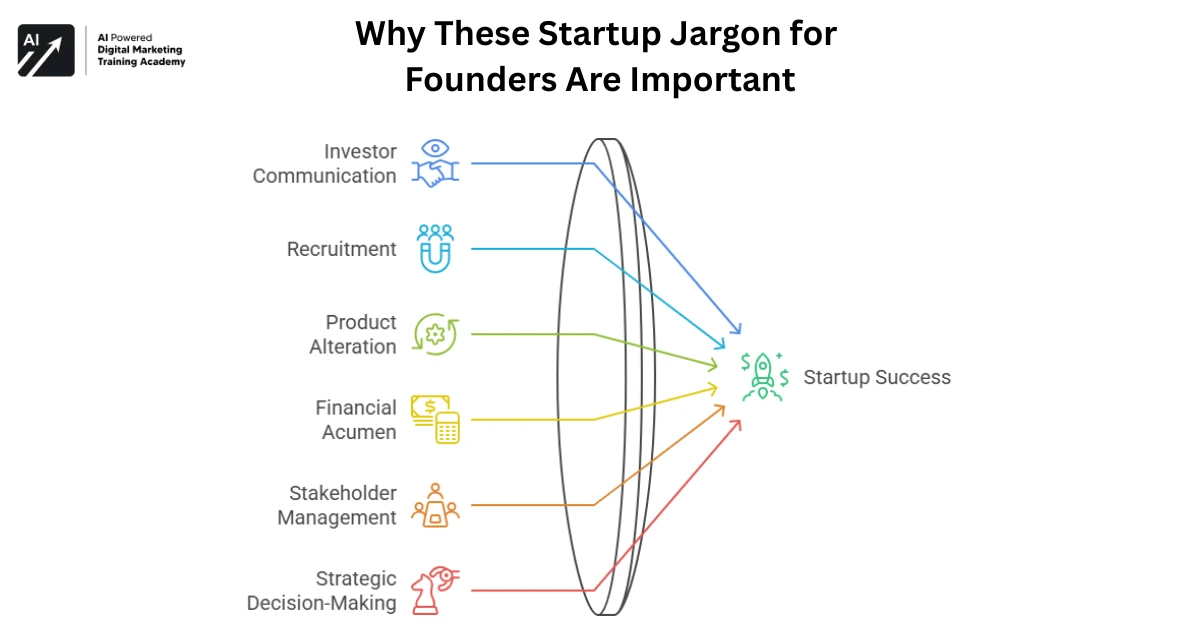

Why These Startup Jargon for Founders Are Important

There is jargon everywhere there is an industry, but in startups it directly determines survival and success.

Misuse of them can be disastrous choices, money loss, or legal cases.

Learning to speak their language gets power into your hands over investors, through recruitment, or through altering products

With the Indian startup ecosystem growing up, every founder needs to keep themselves updated with buzzwords

Whether it’s tech startups, D2C, or SaaS startups, the same principles apply: know the numbers, know the stakeholders, and make wise decisions.

Conclusion

Being a founder is not about launching a product, it’s about launching a company. And that begins with understanding the fundamentals.

These 10 startup cant for founders are not buzzwords; they’re the lexicon of successful founders

Wherever you happen to be, in your moment of desperation, seed capital, first hire, or demo day practice pitching these words will inform your choices and fire your conversation.

The more you know, the more you’ll build with conviction

The next time a “burn rate,” “cap table,” or “MVP” gets dropped you won’t smile and nod. You’ll control the conversation

Comments 1