Saving money is one of the first financial habits most of us learn. However it must be our first salary, a bonus, or some extra income, the default decision is often the same: put the money into a bank fixed deposit. However, exploring government schemes as alternatives to bank fixed deposits can often provide safer, more rewarding, and tax-efficient ways to grow your wealth.

Bank fixed deposits feel familiar and safe. You invest a lump sum, wait for a fixed period, and receive interest. For many years, this worked well. But today, many investors are asking an important question:

Is a bank fixed deposit still the smartest option for growing money? In many cases, the answer is no.

The Indian government offers several savings schemes that are just as safe as bank FDs and, in many situations, more rewarding. Some offer higher interest rates, some provide tax benefits, and others are designed specifically for long-term wealth creation.

In this blog, we will explore five government-backed schemes that can act as government schemes as alternatives to bank fixed deposits,especially for people who want safety, stability, and steady growth.

Why Look Beyond Bank Fixed Deposits?

Before discussing government schemes, it is important to understand the limitations of bank fixed deposits.Bank FDs are safe, but they are not always efficient.

Limitations of Bank Fixed Deposits

- Some common drawbacks include:

- Interest rates often fail to beat inflation

- FD interest is fully taxable as per your income slab

- Limited flexibility for long-term financial goals

- Lower real returns after tax deduction

- Reinvestment risk when rates fall

In simple words, your money may grow on paper, but its actual purchasing power may not improve much over time.

What Makes Government Savings Schemes Special?

Government schemes as alternatives to bank fixed deposits are designed to encourage disciplined saving while offering security and peace of mind.

Key Advantages of Government-Backed Schemes

- These schemes stand out because they are:

- Backed by the Government of India

- Low-risk or near risk-free

- Ideal for conservative and beginner investors

- Often eligible for tax benefits

- Easily accessible through banks and post offices

Now let us look at the five best government schemes that can effectively replace or complement bank fixed deposits.

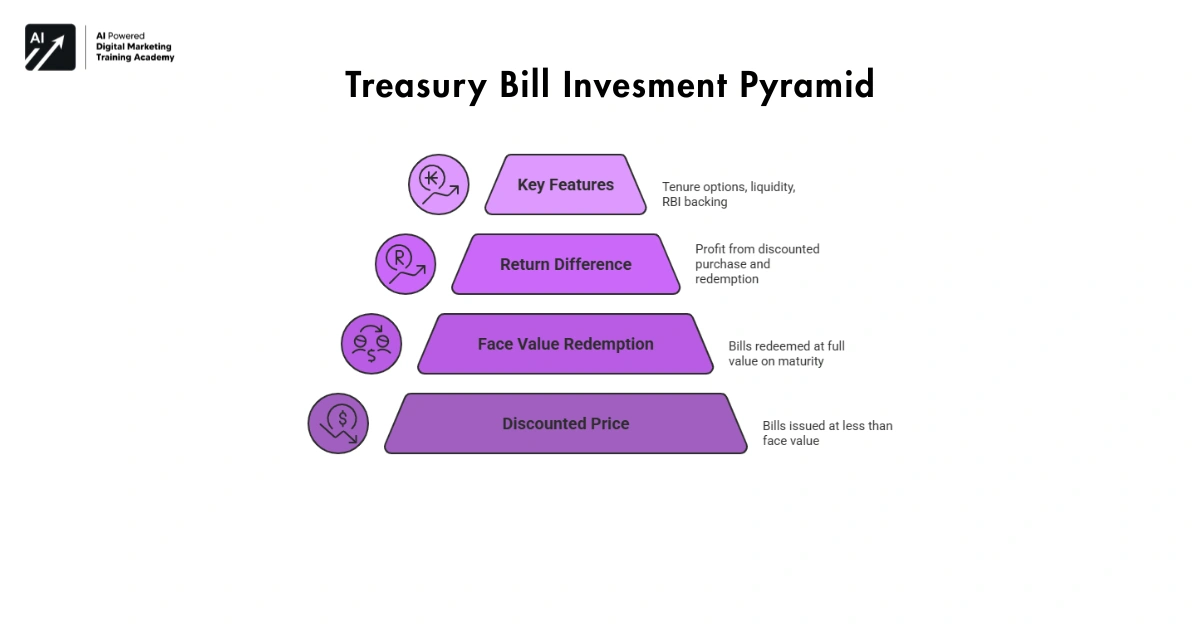

Short-Term Government Investment Option (Treasury Bills )

Treasury bills are like Short-term debt instruments issued by the Government of India and managed by the Reserve Bank of India (RBI).

When you invest in a Treasury Bill,In simple terms, you give your money to the government for a short time, and the government returns it to you with a small gain

How this treasury Bills Work

Treasury Bills do not pay interest in the traditional way. Instead:

- They are issued at a discounted price

- Redeemed at face value on maturity

- The difference is your return

Example:

You invest ₹97,000 today and receive ₹1,00,000 at maturity.

Key Features of Treasury Bills

Tenure options:

- 91 days

- 182 days

- 364 days

- No lock-in beyond maturity

- Highly liquid

- Backed by RBI

- No Section 80C tax benefit

Why T-Bills Are Better Than Short-Term FDs

Treasury Bills are suitable for investors who:

- Want short-term safety

- Need high liquidity

- Want to avoid locking money for years

- Prefer zero market risk

They are especially useful for parking surplus funds temporarily.

Stable Income and Safety for Senior Citizens

This scheme is named as Senior Citizen Savings is designed exclusively for retirees and senior citizens who want stable income and capital protection.

Who Can Invest in SCSS?

- Individuals aged 60 years and above

- Individuals aged 55 – 60 who have opted for voluntary retirement

Key Features of SCSS

- Interest rate is 8.2% per annum

- Interest payout: Quarterly

- Maximum investment: ₹30 lakh

- Initial tenure: 5 years

- Extension available for 3 more years

- Eligible for Section 80C tax deduction

Why SCSS Is Ideal for Retired Individuals

SCSS offers:

- Higher interest than most bank FDs

- Offers regular income for monthly expenses

- Government-backed safety

- Simple account management

For senior citizens, SCSS provides both financial security and peace of mind.

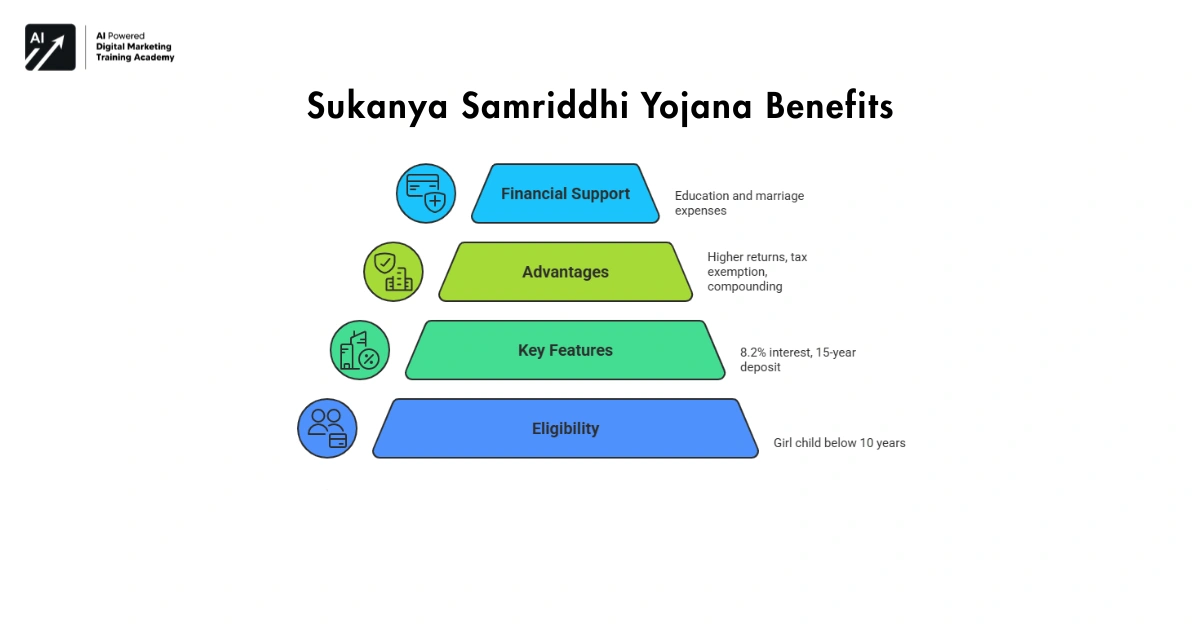

Secure Your Girl Child’s Education and Marriage Expenses

This scheme is named as Sukanya Samriddhi Yojana is a long-term savings scheme focused on securing the future of a girl child.It is one of the most rewarding government schemes as alternatives to bank fixed deposits available today.

Who Can Open an SSY Account?

- Parents or legal guardians

- Girl child must be below 10 years of age

- One account per girl child

Key Features of SSY

- Interest rate is 8.2% per annum

- Maximum annual deposit must be ₹1.5 lakh

- Deposit period is 15 years

- Maturity must be 21 years

- EEE tax status (Exempt-Exempt-Exempt)

Why SSY Beats Most FDs

SSY offers:

- Higher long-term returns

- Complete tax exemption

- Strong compounding benefits

- Dedicated financial support for education and marriage

For parents planning ahead, SSY is one of the strongest wealth-building tools available.

Public Provident Fund (PPF)

PPF is safe because it will combine both safety and flexibility, and long-term benefits and this will be open to all Indian residents: Anyone with a valid ID can start an account.

Here’s why it’s worth considering:

- Interest rate is 7.1% per annum

- Maximum investment per year is ₹1.5 lakh

- Lock-in period will be 15 years

- Partial withdrawals allowed after a few years

- EEE tax benefit

Why PPF Is a Smart FD Alternative

PPF is ideal for:

- Provides Long-term wealth creation

- Tax-efficient savings

- Risk-free compounding

- Retirement planning

Though it requires patience, PPF rewards discipline over time.

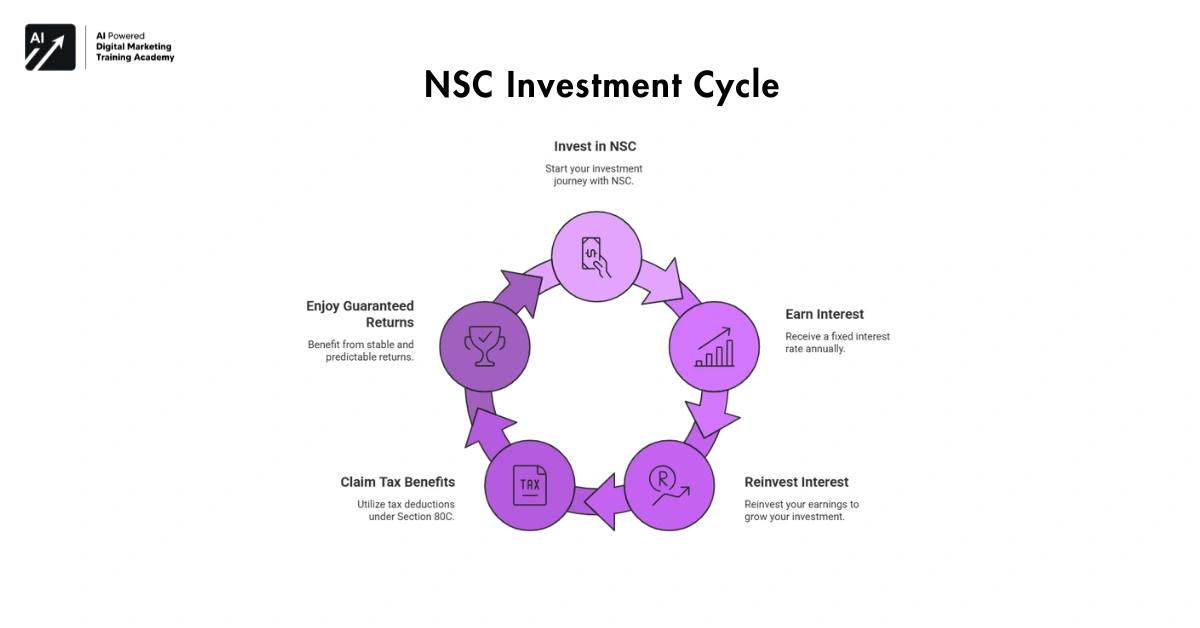

National Savings Certificate (NSC)

NSC means National Savings Certificate which is a fixed-income investment option commonly used for tax-saving purposes.It is simple, predictable and more over easy to understand.

Key Features of NSC

- Tenure time is 5 years

- Interest rate will be 7.7% per annum

- No upper investment limit

- Eligible under Section 80C

- Interest is taxable but reinvested yearly

Why NSC Still Works for Conservative Investors

NSC is suitable for people who:

- Want guaranteed returns

- Prefer low risk

- Need tax deductions

- Do not want market-linked products

It provides stability and certainty, similar to FDs but with added tax benefits.

How Government Schemes Compare to Bank Fixed Deposits

While bank FDs are safe, government schemes as alternatives to bank fixed deposits often offer:

- Better long-term returns

- Tax advantages

- It Provides Purpose-driven savings

- Having Government-backed assurance

Diversifying savings across multiple government schemes can improve returns while maintaining safety.

Choosing the Right Scheme Based on Life Stage

Different life stages require different financial strategies:

- Young professionals: PPF

- Parents:Sukanya Samriddhi Yojana

- Senior citizens: SCSS

- Short-term savers: Treasury Bills

- Tax planners: NSC

Smart investing is about alignment, not chasing returns.

Bank Fixed Deposits vs Government Schemes – A Clear Comparison

Many people trust bank fixed deposits because they feel familiar. But familiarity does not always mean better returns. When we compare FDs with government schemes side by side, some differences become very clear.

Safety and Trust

Both bank FDs and government schemes are considered safe. However:

- Bank FDs depend on the bank’s financial health

- Government schemes are backed directly by the Government of India

- This gives extra confidence, especially during uncertain times

Returns Over Time

- FD interest rates change frequently

- Government schemes usually offer more stable rates

- Long-term schemes like PPF and SSY benefit from compounding

- Tax-free maturity increases actual returns

Tax Impact

Tax is where most people lose money without realizing it:

- FD interest is fully taxable every year

- Many government schemes offer:

- Section 80C benefits

- Tax-free interest

- Tax-free maturity

Over time, this difference can be huge.

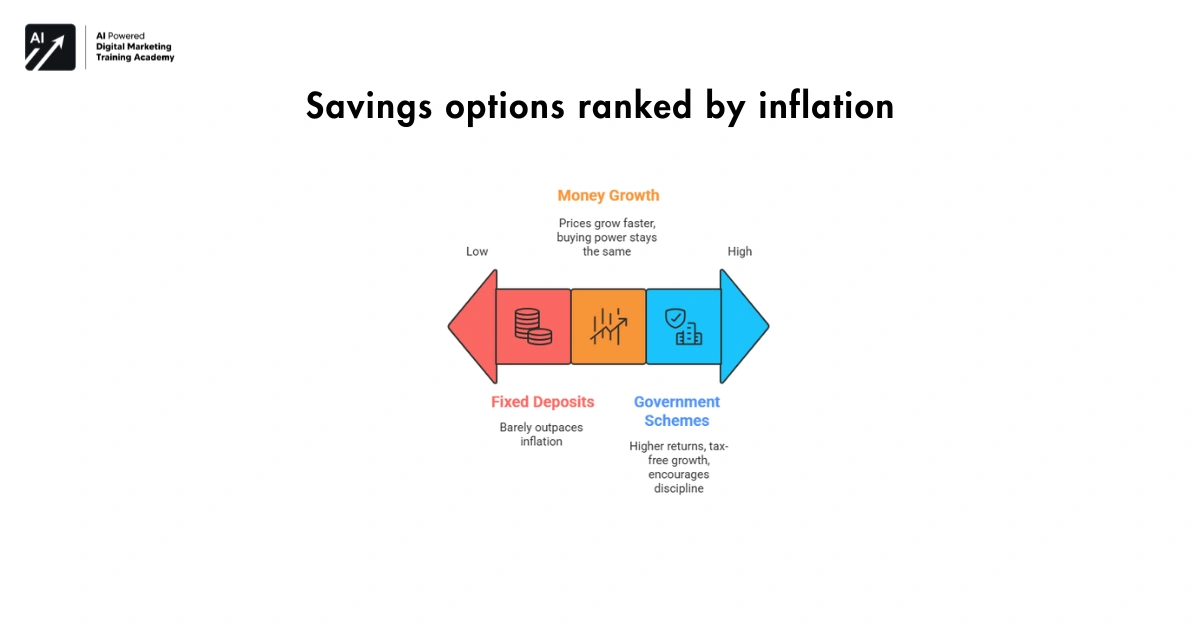

How Inflation Affects Your Savings

Inflation slowly reduces the value of money. This is something many savers ignore.

Why Inflation Matters

If inflation is 6% and your FD gives 6.5%, your real gain is very small.

In simple terms:

- Your money grows

- But prices grow faster

- Your buying power stays almost the same

Government Schemes Handle Inflation Better

Some government schemes help fight inflation by:

- Offering higher long-term returns

- Giving tax-free growth

- This scheme Encourages long-term discipline

That is why they are better for future goals like retirement, education, or family security.

Mistakes People Make While Choosing Safe Investments

Even safe investments can give poor results if chosen wrongly.

Common Mistakes to Avoid

- Putting all money in one FD

- Ignoring tax impact

- Try to choose short-term options for long-term goals

- Not reviewing investments regularly

- Following advice without understanding

Smarter Way to Invest

A better approach is to:

- Split money across different schemes

- Match investments with life goals

- Review your interest rates once a year

- Think long-term, not just short-term safety

How to Build a Balanced Safe Investment Portfolio

You do not have to choose only one option.

Example of a Simple Balanced Plan

working professional:

- PPF for long-term savings

- NSC for tax saving

- Treasury Bills for emergency funds

For parents:

- Sukanya Samriddhi for child’s future

- PPF for retirement

- Small portion in FDs for liquidity

For senior citizens:

- SCSS for regular income

- Short-term T-Bills for flexibility

- Limited FD exposure

This way, money stays safe and grows steadily.

Who Should Still Use Bank Fixed Deposits?

FDs Are Useful When

- You need instant liquidity

- You want very short-term parking

- You are uncomfortable with any lock-in

- You need predictable cash flow

But they should not be the only option.

Are Government Schemes Good for First-Time Savers?

Many people who start saving for the first time feel confused. Stocks feel risky. Mutual funds look complicated. This is where government schemes help.

For beginners, these schemes are easy to understand. You know how much you invest, how long your money stays locked, and what you get in return.

Because the government introduced these schemes, people feel confident putting their hard-earned money into them. This confidence is very important when someone is just starting their financial journey.

Why First-Time Investors Trust Government Schemes

First-time savers prefer government schemes because:

- They are simple to open and manage

- Rules are clear and easy to follow

- Returns are predictable

- Capital safety is a priority

This makes it easier for beginners to stay invested without fear.

Importance of Government Schemes in Long-Term Planning

Long-term planning is not about quick money. It is about building stability slowly.Government schemes support this idea very well. They encourage people to save regularly and stay invested for many years.

Because withdrawals are limited, people are less likely to break their savings habits.These schemes are useful for goals that are many years away, such as retirement, children’s education, or future family needs.

How Discipline Helps Money Grow Over Time

Money grows better when:

- You allow compounding to work

- It stays invested for a long time

- You do not withdraw it often

- You follow a regular saving habit

This is why patient investors benefit the most from these schemes.

Understanding Liquidity Before Investing

- Liquidity means how quickly you can get your money back when needed. Not all government schemes offer the same level of liquidity.

- Some schemes are required for short-term needs, while others are designed strictly for long-term goals. Knowing this helps avoid stress later.

- A good plan always keeps some money easily accessible while the rest stays invested for the future.

Simple Way to Manage Lock-In Periods

You can manage lock-in periods by:

- Keeping emergency money in short-term options

- Using long-term schemes only for long-term goals

- Avoiding unnecessary withdrawals

- Planning expenses before investing

This balance keeps both safety and flexibility intact.

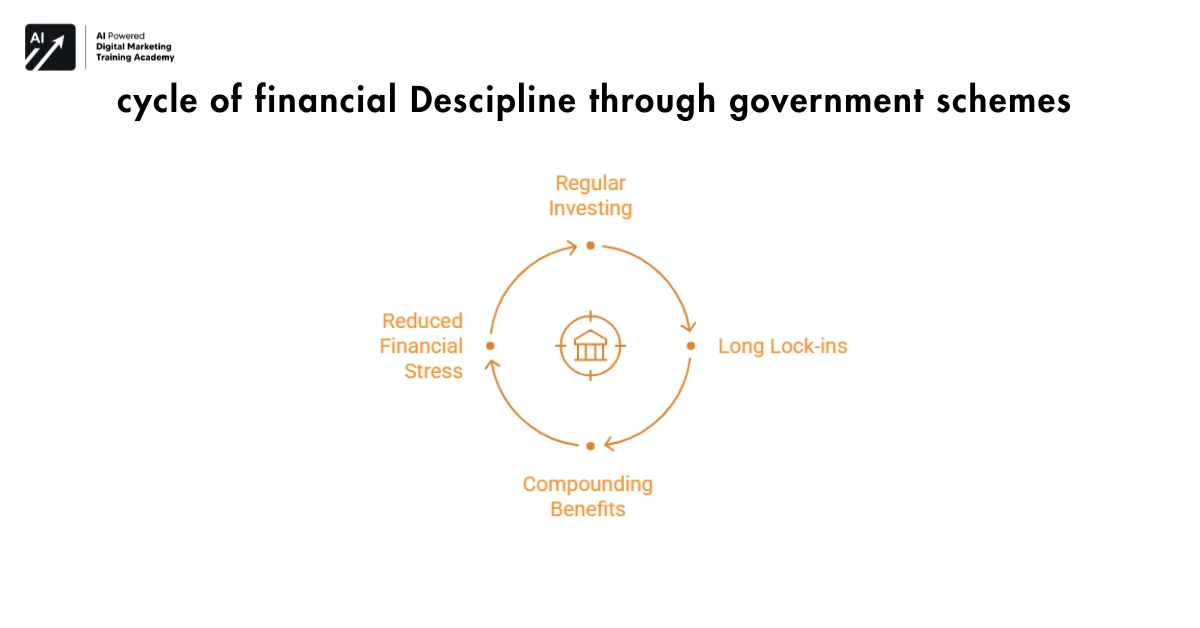

Government Schemes and Financial Discipline

One big benefit of government schemes is that they teach discipline.

H3: Why Discipline Matters

- Regular investing builds habit

- Long lock-ins prevent impulsive withdrawals

- Compounding works best with patience

- Financial stress reduces over time

The reason why schemes like PPF and SSY work so well.

Why Smart Savers Think Long-Term

Smart savers do not chase quick returns.

They focus on:

- Safety is first

- Consistent growth

- Tax efficiency

- Long-term peace of mind

This mindset leads to better financial outcomes.

The Bigger Picture Wealth Is Built Slowly

Wealth does not come from shortcuts. It comes from:

- Regular saving

- Right product selection

- Patience and discipline

- Smart tax planning

Government schemes support all these habits.

A Better Way to Think About Money

Instead of asking:

Where can I get the highest return quickly?

Ask:

Where can my money grow safely for the next 10 – 20 years?

That one change in thinking makes a big difference.

Closing Perspective – Choose Safety With Growth

Bank fixed deposits were once enough. Today, smarter options exist.

Government-backed schemes offer:

- Safety

- Stability

- Better long-term value

- Tax efficiency

You do not need to take risks to grow wealth.You only need to make informed choices.Take time, Plan wisely. Let your money work quietly for you.